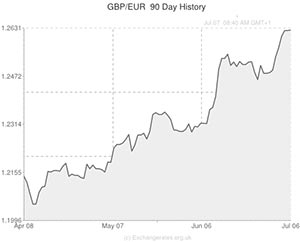

The Pound to Euro (GBP/EUR) exchange rate began the week trading close to a 21-month high as Bank of England rate hike speculation kept Sterling bolstered. However, the Euro was able to advance modestly today thanks to slightly better-than-forecast news from the Eurozone.

This morning began with a bit of disappointment for the 18-nation currency bloc as industrial production in Germany, the Eurozone’s largest economy, declined for a third month.

The level of industrial output in Germany dropped by 1.8%, month-on-month, in May. Stagnation had been expected. April’s figure was negatively revised to a decline of 0.3%.

In the year industrial production was up 1.3%, less than half the annual increase of 3.6% expected and unchanged from the revised result for April.

Economic reports for Germany have been a little patchy of late, and this is the latest in a series of signs that the Eurozone’s superstar performer is struggling.

Strategist Jens-Oliver Niklasch was quoted as saying this of the report; ‘There was a little dent in the second quarter. But generally speaking, the German economy is in quite good shape and there’s no reason for concern as growth rates will remain solid.’

However, any negative impact this report may have had on the appeal of the Euro was outweighed by the news that the Sentix gauge of Investor Confidence for the Eurozone jumped rather than fell in July.

Economists had forecast that the index would slide from 8.5 to 7.8 this month, but it actually advanced to 10.1.

The Sentix report stated; ‘After having receded for two months in a row, the sentix economic index (composite index) for the euro zone increases again in July by 1.6 to now 10.1 points. On the one hand, investors assess the current economic situation as being better than last month. On the other hand, 6-month expectations also increase slightly after having weakened for four consecutive months. This stabilisation of expectations coincides with a European Central Bank taking new expansionary monetary measures.’

Meanwhile, the UK’s Lloyds Employment Confidence Index decreased from 4 to 1 in June. While the UK’s unemployment rate has been falling at a substantial pace, it appears that members of the public aren’t as upbeat about their employment prospects as some would expect them to be.

As the week continues the most likely causes of movement in the GBP to Euro exchange rate will be; UK Manufacturing Production and Industrial Production figures, the National Institute of Economic and Social Research GDP estimate for June, the publication of the ECB’s monthly report, UK Trade Balance figures, the Bank of England’s interest rate decision and German inflation data.

The Pound to Euro (GBP/EUR) exchange rate was slightly softer following the publication of today’s reports, but Sterling’s bullish relationship with its European cousin could continue if this week’s other UK fundamentals impress.

UPDATED 13:10 GMT 7 June, 2014

Pound to Euro (GBP/EUR) Exchange Rate Falters

The Pound to Euro (GBP/EUR) exchange rate shed 0.15% as trading continued on Monday.

While the UK’s Lloyd’s Employment Confidence index had little impact, Sterling also posted a modest decline against the US Dollar amid bets that the British currency’s recent rally has been excessive.

A prominent measure of bullish bets achieved its strongest level since 2007, intimating that there is little scope for fresh Pound buys.

If tomorrow’s UK Manufacturing and Industrial Production reports fail to show the level of improvement anticipated, the GBP/EUR pairing could edge lower still as the week progresses.

UPDATED: 08:40 GMT 08 July, 2014

Pound to Euro (GBP/EUR) Exchange Rate Movement Ahead

As the European session got under way data showed that Germany’s trade surplus widened in May. However, the Euro failed to benefit from this news as the report detailed an unexpectedly steep decline in exports.

Exports in the Eurozone’s largest economy where shown to have fallen by a seasonally adjusted 1.1% in May, month-on-month. A less extensive drop of 0.4% had been forecast.

However, imports in the same period plummeted by 3.4% instead of climbing the 0.5% expected by economists.

Consequently, Germany’s trade balance came in at 18.8 billion Euros in May, up from 17.2 billion Euros in April and beating expectations for a figure of 16.2.

French trade data also had an impact.

The Pound to Euro (GBP/EUR) exchange rate advanced by 0.14% ahead of the publication of the UK’s Manufacturing and Industrial production figures.

Euro Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Euro, ,Pound Sterling,0.7928,

,Pound Sterling,0.7928,

Euro, ,US Dollar,1.3592,

,US Dollar,1.3592,

Euro, ,Canadian Dollar,1.4478,

,Canadian Dollar,1.4478,

Euro, ,Australian Dollar,1.4523,

,Australian Dollar,1.4523,

Euro, ,New Zealand Dollar,1.5560,

,New Zealand Dollar,1.5560,

US Dollar, ,Euro ,0.7361,

,Euro ,0.7361,

Pound Sterling, ,Euro,1.2614,

,Euro,1.2614,

Canadian Dollar, ,Euro,0.6907,

,Euro,0.6907,

Australian Dollar, ,Euro,0.6887,

,Euro,0.6887,

New Zealand Dollar, ,Euro,0.6427,

,Euro,0.6427,

[/table]

Comments are closed.