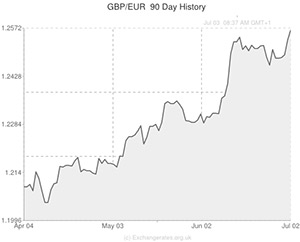

The Pound to Euro exchange rate edged higher on Thursday after the European Central Bank (ECB) chose to leave its monetary policy unchanged in order to see how effective the extraordinary measures it introduced in June will be.

Economists had widely expected the ECB to leave policy unchanged. Comments made by ECB President Mario Draghi weakened the Euro as he said that the record low interest rate of 0.15% will remain in place for an extended period of time and as he warned that significant challenges to the region’s economy remain.

Investors were also left disappointed after Draghi announced that the frequency of the Central Banks Governing policy meetings will be reduced to occurring just once every six weeks next year.

With the Euro crisis not going away outsiders may well be wondering at the wisdom of such a move.

Draghi also warned that unemployment in the Eurozone is still too high and said that the economy remains exposed to weakness.

The GBP to Euro exchange rate is trading up at 1.2593 – (03/07/14 at 14:40 GMT)

Against the US Dollar the Euro dropped close to 1.36 as investors deemed Draghi’s comments as more dovish than they had expected.

A separate report showed that new lending to the private sector has been declining for more than a year, a sign that the central bank’s pump-priming efforts have not been working.

France saw a sharp drop with activity falling by its fastest pace in four months. Even Germany, the region’s largest economy, saw its pace of growth slow.

Data released earlier in the session also weighed upon the single currency as it showed that businesses in the Eurozone expanded at their slowest pace in six months in June.

The Pound climbed as the comments showed how much the Bank of England’s (BoE) and ECB’s policies are diverging as the UK continues to perform strongly and the Eurozone stagnates.

Sterling was continuing to find support from expectations that an interest rate rise could occur before the end of this year.

The ‘Greenback’ advanced after a report released by the Washington based Labour Department showed that the US economy created 288,000 jobs last month, smashing forecasts for a figure of 212,000.

The data suggests that the world’s largest economy is strengthening and expectations for a rate rise by the Federal Reserve increased.

If Friday’s German factory order data comes in worse than the -1.0% expected by economists then we can expect the Euro to end the week lower against the Pound.

UPDATED: 15:15 GMT, 04 July, 2014

Pound to Euro (GBP/EUR) Exchange Rate Riding High

The Pound to Euro (GBP/EUR) exchange rate pushed higher still on Friday after Germany’s factory orders figures disappointed expectations.

Recent data for the Eurozone has been patchy in nature, justifying the European Central Bank’s dovish stance and the potential introduction of additional stimulus measures in the near future.

Today’s German Factory Order’s report added to the pile of less-than-impressive results, detailing a monthly decline of -1.7% which was steeper than the anticipated drop of -1.1%.

The following statement was issued with the figures; ‘In light of the good start into the second quarter, one can assume factory orders will increase on average in the second quarter. At the moment, however, one can observe a certain reservation, probably due to increased geopolitical risks. Overall, the upswing in manufacturing should continue at a moderate pace’.

The GBP/EUR exchange rate advanced by a further 0.14% to trade above 1.26 during the local session.

If next week’s UK reports continue to add to the argument in favour of the Bank of England raising interest rates strength in the Pound to Euro (GBP/EUR) exchange rate could persist.

Euro Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Euro, ,US Dollar,1.3606 ,

,US Dollar,1.3606 ,

Euro, , Pound Sterling,0.7946 ,

, Pound Sterling,0.7946 ,

Euro, ,Australian Dollar,1.4572 ,

,Australian Dollar,1.4572 ,

Euro, ,Canadian Dollar,1.4516 ,

,Canadian Dollar,1.4516 ,

Pound Sterling, ,Euro,1.2593 ,

,Euro,1.2593 ,

US Dollar, ,Euro,0.7352 ,

,Euro,0.7352 ,

[/table]

Comments are closed.