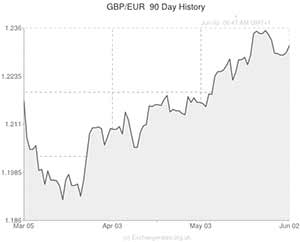

The Pound to Euro exchange rate (GBP/EUR) rose ever so slightly yesterday as markets reacted to a couple of disappointing data releases in Germany.

GBP/EUR breached psychological resistance at 1.2300 and settled at 1.2315 due to a slowdown in Eurozone manufacturing output (from 52.5 to 52.2). Another month of contracting output in France (49.6) and an unexpected cooling of German activity (from 52.9 to 52.3) were the main drivers behind the soft PMI print.

The single currency was later impacted by an anaemic consumer price index report out of the currency bloc’s largest economy. The headline German inflation rate decelerated from 1.3% to 0.9%, whilst on an EU-adjusted basis price pressures fell to a 4-year low of 0.6%. The worryingly low CPI figures heaped pressure on the Euro as investors upped their ECB stimulus bets.

The European Central Bank is widely expected to cut the benchmark interest rate from 0.25% to 0.10% and bring its deposit rate down from 0.00% to -0.10% on Thursday. The majority of traders have already priced this outcome into the Euro exchange rate, however, there is still potential for the single currency to depreciate if the ECB pulls through on recent dovish rhetoric.

There is also potential for the ECB to provide additional stimulus. Perhaps in the form of quantitative easing or via desterilising bonds obtained from the SMP (Securities Market Programme). If the European Central Bank does decide to act with more than just a range of rate cuts then it is highly likely that the single currency will plummet against the Pound.

Later this morning fresh Eurozone data could shed some light on how aggressive the ECB’s monetary easing measures may need to be.

Eurozone unemployment, a persistent threat to growth in the region, is expected to print at 11.8% – anything higher will likely weigh on the single currency.

Perhaps the most important figure for the ECB to consider this week is May’s measure of consumer prices in the currency bloc. Analysts predict that price pressures slowed to 0.6% last month, but with German CPI cooling so rapidly yesterday there is potential for an even softer figure of 0.5% or below.

The Euro could well decline against the Pound during tomorrow’s session if Eurozone inflation prints disappointingly. And it is possible that GBP/EUR could rally towards a fresh 1.5-year high on Thursday afternoon if the ECB decides to act aggressively.

The Sterling to Euro exchange rate struck an 18-month high of 1.2373 on May 23rd and it is possible that GBP/EUR could match that and challenge the 1.2400 handle on Thursday if Mario Draghi unleashes a strong set of stimulus measures.

Comments are closed.