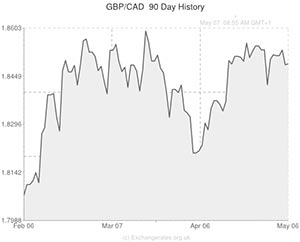

On Wednesday the Pound to Canadian Dollar pairing (GBP/CAD) held onto recent gains before edging higher during the North American session.

Yesterday data revealed an unexpected decline in Canada’s merchandise trade surplus, prompting Toronto-based economist Benjamin Reitzes to comment; ‘Trade still has a way to go before it’s going to meaningfully add to growth.’

Canada’s Ivey purchasing managers index also showed a decline.

However, US Dollar outflows lent the Canadian Dollar support and in the CAD/USD pairing the ‘Loonie’ came out on top.

The Canadian Dollar’s relationship with the Pound was a whole different story however and the UK’s surprisingly strong services report for April buoyed the GBP/CAD exchange rate.

Despite a lack of UK data on Wednesday Sterling continued to hold its own. Canada’s currency also came under pressure after the release of dismal Canadian building permits figures.

Economists had expected Canadian building permits to increase by 4.3 per cent in March, month-on-month, following a positively revised decline of 11.3 per cent in February.

However, permits slumped by 3.0 per cent.

The figures were compiled by Statistics Canada and revealed that a reduction in non-residential construction intentions counteracted the more modest advance in the residential sector.

While the value of residential-sector permits increased by 1.0 per cent, the value of non-residential permits dropped by 8.8 per cent to its lowest level for over a year.

Although markets have come to expect patchy data releases from Canada, the nation’s currency still edged lower in response to the report, falling to session lows against the ‘Greenback’ and consolidating declines against the Pound.

Sterling, meanwhile, was enjoying a bullish relationship with the majority of its currency counterparts ahead of tomorrow and the Bank of England’s rate decision.

The central bank is widely expected to leave interest rates unaltered and fiscal policy unchanged. However, as recent UK economic reports (including last month’s impressive employment figures) are supporting the case for an interest rate increase occurring sooner rather than later, the BoE may well issue a more hawkish policy statement than we’ve come to expect.

If that proves to be the case the Pound could broadly strengthen.

In the opinion of currency strategist Jane Foley; ‘The BOE is still in the running to be the second developed central bank to hike rates this cycle’.

Conversely, if Fed Chairwoman Janet Yellen delivers a dovish testimony to the Economic Committee later today, as economists envisage, US Dollar declines are likely.

Before the weekend further CAD/GBP movement could occur as a result of Canada’s housing starts and new house price index and domestic employment figures.

Canada’s unemployment rate is expected to hold at 6.9 per cent in April.

Of course the BoE decision and UK reports (including trade figures and manufacturing/industrial production data) may also have an impact on the commodity-driven currency’s performance against the Pound.

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5408,

,Pound Sterling,0.5408,

Canadian Dollar, ,US Dollar,0.9179,

,US Dollar,0.9179,

Canadian Dollar, ,Euro,0.6587,

,Euro,0.6587,

Canadian Dollar, ,Australian Dollar,0.9835,

,Australian Dollar,0.9835,

Canadian Dollar, ,New Zealand Dollar,1.0467,

,New Zealand Dollar,1.0467,

US Dollar, ,Canadian Dollar ,1.0900,

,Canadian Dollar ,1.0900,

Pound Sterling, ,Canadian Dollar,1.8489,

,Canadian Dollar,1.8489,

Euro, ,Canadian Dollar,1.5175,

,Canadian Dollar,1.5175,

Australian Dollar, ,Canadian Dollar,1.0170,

,Canadian Dollar,1.0170,

New Zealand Dollar, ,Canadian Dollar,0.9435,

,Canadian Dollar,0.9435,

[/table]

Comments are closed.