The Pound to Canadian Dollar exchange rate initially fell on Monday as Sterling softened in response to bets that its recent rally had been overdone.

However, patchy domestic data and fluctuating commodity prices went on to pare any losses in the GBP to CAD pairing.

Firstly, Brent crude oil (Canada’s main commodity) dipped to its lowest price for almost a month, with futures shedding 0.2% in response to the news that exports from Libya will be increasing.

As asserted by one Copenhagen-based analyst, ‘Libya is finally set to return to the market, and the oil price reflects that. We could see the Iraq premium decline in the future as risk is limited to supplies from the main production sites in the south.’

In other commodity news, gold prices extended their decline as Iraq-tensions eased and increasing stockpiles have driven down the price of copper.

In terms of Canadian economic news, while the number of building permits issued in the nation were shown to have surged in May, June’s Ivey Purchasing Managers Index fell short of forecasts.

Canadian Building Permits jumped by 13.8% in May, month-on-month, rather than rising the far more modest 2.0% economists expected. This followed a monthly increase of 2.2% in April.

The report detailed a 20.8% increase in non-residential construction permits.

This report confounds previous data showing a stabilisation of Canada’s housing market.

As the North American session continued, the Pound to Canadian Dollar (GBP/CAD) exchange rate was affected by the news that Canada’s Ivey Purchasing Managers Index came in at a non-seasonally adjusted 46.9 in June, down from 48.2 in May and defying expectations for a reading of 52.0.

The gauge stayed well below the 50 mark separating growth from contraction.

The result was a six-month low and supports the case for the Bank of Canada leaving interest rates on hold for the foreseeable future.

Meanwhile, Canada’s Business Outlook Future Sales figure for the second quarter of the year came in at 24.

This was a modest slide from the figure of 27 registered in the first three months of the year and was less than the reading of 30 forecast by economists.

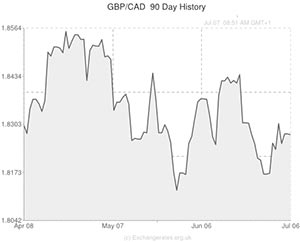

During the North American session the Pound to Canadian Dollar exchange rate was static having hit a low of 1.8185 and rebounding to a high of 1.8287.

Tomorrow’s UK Manufacturing and Industrial Production reports for the UK could dictate what direction the GBP to CAD pairing takes ahead of the release of Canadian employment figures – due out on Friday.

UPDATED: 11:20 GMT 08 July, 2014

Pound to Canadian Dollar (GBP/CAD) Exchange Rate Sheds Gain

Concerning Industrial and Manufacturing Production data drove the Pound to Canadian Dollar exchange (GBP/CAD) rate lower over the course of the European session.

The pairing fell to a low of 1.8234 before a correction saw Sterling pare its loss to 0.15% to trade in the region of 1.8280.

As today’s lacklustre UK reports add to the case for the Bank of England leaving interest rates on hold, the Pound also weakened against the ‘Aussie’, ‘Kiwi’, ‘Greenback’ and Euro.

Today is light in terms of Canadian economic news but the US jobs figures and consumer credit report could have a slight impact on the Pound to Canadian Dollar (GBP/CAD) exchange rate.

As the week progresses investors have Canadian Housing Starts figures and Canadian employment data to look forward to.

UPDATED 09:20 GMT 09 July, 2014

Pound to Canadian Dollar (GBP/CAD) Exchange Rate Holds Modest Declines

As Canadian economic news was lacking on Tuesday, movement in the Pound to Canadian Dollar exchange rate was largely caused by developments in the UK.

The UK’s less-than-impressive Manufacturing and Industrial Production reports did inspire significant Sterling losses yesterday, but the British asset largely recovered ground before the close of the local session and is currently trading just 0.1% lower against the ‘Loonie’.

The USD/CAD exchange rate was trading in the region of 1.0679 after hitting a high of 1.0683.

As Wednesday continued the Pound to Canadian Dollar (GBP/CAD) exchange rate could fluctuate in response to Canadian Housing Starts figure – due out at 13:15 GMT.

Investors will also be looking ahead to Friday and the publication of Canadian employment data.

Pound (GBP) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,US Dollar,1.7123,

,US Dollar,1.7123,

Pound Sterling, ,Euro,1.2593,

,Euro,1.2593,

Pound Sterling, ,Australian Dollar,1.8280,

,Australian Dollar,1.8280,

Pound Sterling, ,New Zealand Dollar,1.9567,

,New Zealand Dollar,1.9567,

US Dollar, ,Pound Sterling,0.5842,

,Pound Sterling,0.5842,

Euro, ,Pound Sterling,0.7941,

,Pound Sterling,0.7941,

Australian Dollar, ,Pound Sterling,0.5473,

,Pound Sterling,0.5473,

New Zealand Dollar, ,Pound Sterling,0.5110,

,Pound Sterling,0.5110,

[/table]

Comments are closed.