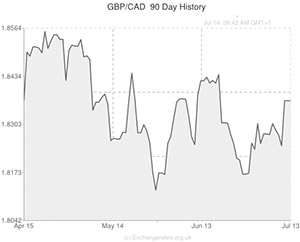

The UK’s impressive inflation report for June saw the Pound to Canadian Dollar (GBP/CAD) exchange rate surge by over 0.5% on Tuesday.

The GBP to CAD pairing achieved a high of 1.8431 in the immediate aftermath of the UK data release and largely retained its advance during the European session.

Sterling was also notably stronger against the US Dollar, Euro and Australian Dollar.

Before the UK’s Consumer Price Index was released, the Pound was struggling slightly as investors pared their Bank of England rate hike bets following last week’s disappointing domestic reports.

The asset also came under pressure as the British Retail Consortium issued its latest like-for-like sales data.

The sales report detailed a very modest 0.6% increase in total retail sales spending last month. This was the lowest pace of sales growth recorded for over three years.

On a quarterly basis, sales growth increased by 2.6%, a fairly robust figure.

In the opinion of industry expert David McCorquodale; ‘Concern over a potential rise in interest rates is having a dampening effect on retail sales. Even sales of home accessories and furniture flatlined, which is surprising given the UK is reportedly in the midst of a housing boom […] Consumers continue to benefit from competitive pricing, which may be the cause of softer like-for-like sales in June.’

However, any adverse impact this data may have had on the Pound was wiped out as the UK’s CPI for June showed a year-on-year figure of 1.9% and a month-on-month figure of 0.2%. Economists had anticipated an annual price gain of 1.6% and a monthly price decline of -0.1%.

The data shows that inflation is close to the Bank of England’s 2% target.

The odds of the BoE hiking borrowing costs in November rose considerably after this report was published and the Pound rallied against its peers as a result.

The Pound to Canadian Dollar exchange rate was little changed following the release of Canada’s Existing Home Sales data.

The report showed that existing home sales in the nation increased by 0.8% in June on a month-on-month basis, far less than the monthly gain of 5.9% recorded in May.

The Canadian Real Estate Association (responsible for compiling the report) released the following statement with the figures; ‘Sales have improved compared to their slower start earlier this year. That said, there are still important differences in how housing markets are faring depending on location, housing type and price point.’

CREA economist Gregory Klump added; ‘At least some of the recent burst in new supply reflects the slow start to the year, when a harsh winter caused many sellers to delay listing their home in many parts of the country. In markets with tight supply and strong demand, the strength of sales in recent months reflects how many properties were snapped up once they finally hit the market.’

The Pound to GBP to CAD exchange rate is likely to hold on to today’s gains ahead of tomorrow’s UK employment data.

If the jobs figures show a decline in unemployment and, more crucially, an increase in average wage growth, Sterling’s upward momentum will continue and the currency could touch fresh highs.

Investors with an interest in the Canadian Dollar will also be focusing on Canada’s manufacturing shipments report for May. A month-on-month gain of 1.3% has been forecast.

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5430,

,Pound Sterling,0.5430,

Canadian Dollar, ,US Dollar,0.9322,

,US Dollar,0.9322,

Canadian Dollar, ,Euro,0.6852,

,Euro,0.6852,

Canadian Dollar, ,Australian Dollar,0.9935,

,Australian Dollar,0.9935,

Canadian Dollar, ,New Zealand Dollar,1.0585,

,New Zealand Dollar,1.0585,

US Dollar, ,Canadian Dollar ,1.0728,

,Canadian Dollar ,1.0728,

Pound Sterling, ,Canadian Dollar,1.8415,

,Canadian Dollar,1.8415,

Euro, ,Canadian Dollar,1.4601,

,Canadian Dollar,1.4601,

Australian Dollar, ,Canadian Dollar,1.0060,

,Canadian Dollar,1.0060,

New Zealand Dollar, ,Canadian Dollar,0.9439,

,Canadian Dollar,0.9439,

[/table]

Comments are closed.