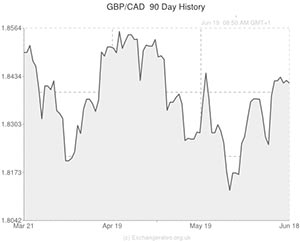

The Pound to Canadian Dollar exchange rate slid on Wednesday as the odds of the Bank of England hiking interest rates over the next few months declined markedly following the release of minutes from the latest BoE meeting.

Sterling eased lower against almost all of its major currency counterparts as the minutes showed that the nine members of the Monetary Policy Committee were united in their decision to keep interest rates at record lows in June.

While recent comments issued by several prominent BoE officials had led investors to bet that borrowing costs would be increased before next spring (and pushed the Pound higher against its rivals in the process) the minutes indicated that several members of the MPC believe interest rates should remain on hold until the level of slack in the UK economy is absorbed.

Although the BoE did intimate that an interest rate increase is on the horizon, the minutes lacked the sense of urgency some investors had been hoping for and Sterling broadly softened.

In the opinion of London-based currency strategist Jane Foley: ‘The complicating factor is the CPI data yesterday. There will still be many economists who still think the bank will ultimately be deterred from a rate hike this year. Looking at Cable it very much depends what the Fed do. If they announce more of a hawkish trajectory this afternoon you could see Cable coming right down again.’

The Federal Open Market Committee will issue its policy statement at 19:30 GMT.

As European trading progressed the Pound shed 0.22 per cent against the Euro, 0.10 per cent against the US Dollar and 0.10 per cent against the Canadian Dollar.

Meanwhile, the ‘Loonie’ derived some support from the news that Canadian wholesale sales came in at their strongest level for nine months in April.

Sales were up 1.2 per cent in April month-on-month, double the 0.6 per cent monthly gain anticipated and up from a positively revised decline of 0.3 per cent. Sales were up in every sector apart from tobacco and food, with the sale of building materials leading the overall advance.

Canadian data is thin on the ground tomorrow, although movement in the GBP/CAD pairing could be inspired by the UK’s retail sales report.

As sales (including autos) are expected to have declined by 0.5 per cent on the month in May, an unexpected increase could give the Pound a boost. Of course investors will also be focusing on Friday and the publication of Canadian inflation figures.

GBP to CAD Update – 19/06/14

The Pound to Canadian Dollar exchange rate achieved a high of 1.8456 on Thursday as investors offered a muted response to the UK’s retail sales report.

The ‘Loonie’ had spiked against Sterling on Wednesday in response to tame Bank of England meeting minutes, but the commodity-driven currency shed these gains in a quiet North American session.

Limited Sterling movement was inspired by the UK’s retail sales report, which brought an end to a recent run of notable sales gains by showing a 0.5 per cent month-on-month decline in May. The dip in the level of retail sales in the UK came even as sales of World Cup paraphernalia soared.

Store prices were down by 0.7 per cent, the most considerable decline since 2009. In the view of economist Simon Wells; ‘While this no doubt reflects Sterling strength over the past year and a competitive retail environment, it is indicative of the low-inflation environment the UK currently finds itself in.’

Further volatility in the GBP to CAD pairing may be on hold until tomorrow. While the UK’s public finance figures will be of interest to investors, Canada’s consumer price index and retail sales data will be the main cause of market movement.

Retail sales in the North American nation are expected to have increased by 0.6 per cent month-on-month in April following a decline of 0.1 per cent in March.

Comments are closed.