The main event on the economic calendar this afternoon is July’s Canadian consumer price index report. The data is predicted to show that Canadian inflation slowed last month from 2.4% to 2.2%.

However, the decrease in inflationary pressures is unlikely to cause the Canadian Dollar too much trouble because 2.2% is still in the upper half of the Bank of Canada’s consumer price index 1.0%-3.0% target range.

With inflation stuttering around the 1.6% mark in Britain and CPI floundering close to stagnation at 0.4% in the Eurozone it would be folly for investors to punish the ‘Loonie’ for an inflation rate north of 2.0%.

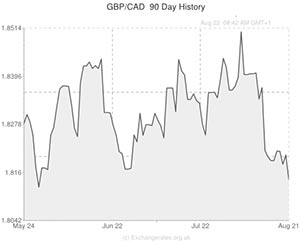

If the report exceeds analysts’ predictions then demand for the Canadian Dollar could surge and GBP to CAD could depreciate. If the Pound to Canadian Dollar exchange rate falls by as little as half a cent then Sterling will strike a fresh 6-month low of 1.8099 against the ‘Loonie’.

However, if the CPI reading comes in below consensus then it could damage demand for the Canadian Dollar and push GBP/CAD higher towards 1.8200.

Poor British retail sales

The Pound struggled against the majors during yesterday’s session, including a half-cent decline against the ‘Loonie’, as markets reacted to a disappointing set of UK retail sales numbers.

July’s retail sales report showed that sales volumes improved by just 0.1% on the month, underwhelming predictions of 0.4%. The year-by-year index also disappointed, printing at an 8-month low of 2.6% compared to forecasts of 3.1%.

Sterling traders were particularly sensitive to the inflation element of the retail sales report. Shockingly, it emerged that for the first time since records began in 1989 the amount of money spent in food stores actually plummeted, by -1.3% last year. The average price paid for goods shrunk by -0.9% between July 2013 and July 2014.

The unexpected drop in retail price pressures weighed on demand for the Pound because Britain’s soft inflationary outlooks is seen as one of the main reasons that the Bank of England has thus far refrained from raising interest rates.

Sterling’s best chance of reprieve in the medium term is for wage growth to miraculously rise from the doldrums towards a more respectable level. In light of recent comments from BoE Governor Mark Carney it seems entirely likely that the bank will begin its hiking cycle if average earnings approach, or better yet, overtake, the rate of inflation. British CPI inflation currently stands at 1.6%, whilst average earnings are currently decreasing by -0.2%.

Comments are closed.