A risk-off environment and declining iron ore prices saw the commodity-driven Australian Dollar ease lower against the Pound on Monday.

The ‘Aussie’ lost ground against several of its major rivals on Monday as violent clashes in Ukraine and anti-China demonstrations in Vietnam soured risk appetite.

Shares in industrial, mining and energy sectors declined, also causing the Australian Dollar to lose appeal overnight.

In the view of forex trader Tony Darvall; ‘The Aussie Dollar does well when stocks do well and when China is out of the headlines. […] If iron ore prices continue to drop and Australian stocks continue to drop, the Australian Dollar won’t do very well. It’s a bit of a warning sign telling traders to be careful.’

The Pound was also supported by the expectation that this week’s UK inflation data could support the case for the Bank of England increasing interest rates sooner than currently scheduled.

Although Bank of England Governor Mark Carney recently warned that the jump in UK house prices is the number one economic risk facing the nation, Sterling continued trading in a stronger position against the ‘Aussie’.

The Pound even held gains after a domestic report showed that UK house prices climbed by 3.6 per cent in May month-on-month and were up 8.9 per cent on the year.

During Australasian trading the nation’s conference board leading index and the publication of minutes from the Reserve Bank of Australia’s May meeting could have a significant impact on the GBP to AUD exchange rate. If the minutes indicate that interest rates will remain on hold for the foreseeable future, or else hint that the strength of the ‘Aussie’s is detrimental, the Pound could extend gains against its South Pacific rival.

Tomorrow’s UK inflation data will be a big market mover tomorrow.

Economists have forecast that the consumer price index was up 0.3 per cent on the Month in April and 1.7 per cent on the year.

As the week progresses investors will also be taking an interest in Australia’s consumer confidence index and the UK’s retail sales report.

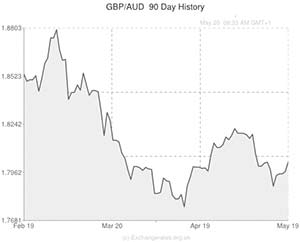

Pound to Australian Dollar Update – 20/05/14

The Australian Dollar was already trading slightly lower against the Pound due to a risk-off environment, but the GBP to AUD pairing was able to extend gains after the minutes from the latest Reserve Bank of Australia policy meeting were published.

The minutes reasserted the central bank’s commitment to keeping interest rates at record-lows for some time to come and saw the Australian Dollar lose ground against almost all of its currency counterparts.

Over the course of Australasian trading the ‘Aussie’ brushed a two week low against the US Dollar.

As well as intimating that a course of interest rate stability will be pursued, the RBA minutes stated that the Australian economy is acclimatising to decline in mining production and that inflation is contained at the moment.

The minutes stated; ‘The board noted that overall growth in coming quarters was likely to be below trend given expected slower growth in exports, the decline in mining investment and the planned fiscal consolidation. [Consequently] The current accommodative stance of policy was likely to be appropriate for some time yet.’

Currently the GBP/AUD pairing is 0.80 per cent stronger.

However, as the day continues the Pound to Australian Dollar exchange rate could experience considerable volatility as a result of the UK’s own inflation figures.

If consumer prices are shown to have increased by more than the 1.7 per cent expected the Pound could rally.

Australian Dollar (AUD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Australian Dollar, ,US Dollar, 0.9278,

,US Dollar, 0.9278,

Australian Dollar, ,Euro, 0.6769,

,Euro, 0.6769,

Australian Dollar, ,Pound, 0.5514,

,Pound, 0.5514,

Australian Dollar, ,New Zealand Dollar, 1.0802,

,New Zealand Dollar, 1.0802,

US Dollar, ,Australian Dollar, 1.0784,

,Australian Dollar, 1.0784,

Euro, ,Australian Dollar, 1.4771,

,Australian Dollar, 1.4771,

Pound Sterling, ,Australian Dollar, 1.8139,

,Australian Dollar, 1.8139,

New Zealand Dollar, ,Australian Dollar, 0.9264,

,Australian Dollar, 0.9264,

[/table]

Comments are closed.