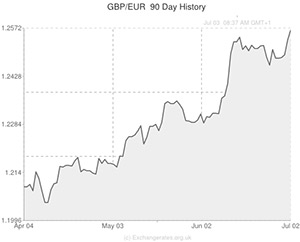

The Pound to Euro exchange rate fluctuated modestly on Thursday as the UK’s Services PMI report was published.

Both the UK’s Services and Composite PMI measures were expected to show a modest decline, but the indexes actually fell by more-than-expected in June. This was particularly surprising given the fact that both this week’s UK Manufacturing and Construction PMI’s have come in well above forecast.

The Services PMI slipped from 58.6 to 57.7 in June. A reading of 58.3 had been expected.

Meanwhile, the Composite measure (which economists had envisaged easing from 59 to 58.0) actually edged down to 58.0.

While these results were a little disappointing, the UK services sector is still registering record levels of employment growth. The fact that the report also detailed higher wages was particularly encouraging in light of last month’s lacklustre wage growth data.

Markit economist Chris Williamson said this of the result; ‘Yet another strong services sector PMI number indicates the UK economy continued to boom in June. Alongside an ongoing surge in construction and the largest quarterly rise in manufacturing output for 20 years, the services PMI confirms that the economy is firing on all cylinders. We expect the economy to grow by 0.8% again in the second quarter, taking GDP to an all-time high.’

The Pound was a little weaker against both the Euro and US Dollar after the data was published, although, declines against the Euro were limited as the common currency came under pressures of its own.

The Eurozone’s retail sales figures showed unexpected stagnation in May. Economists had envisaged sales growth of 0.3%. This followed a negatively revised decline of -0.2%. in April.

Sales were up 0.7% on the year, significantly less than the 1.8% annual increase analysts had anticipated.

Sterling’s decline against the US Dollar was the first for six days, but the dip could be extended if today’s US Non-Farm’s Payrolls report comes in above expected levels. A particularly strong jobs gain could see the GBP to USD exchange rate struggle during the North American session.

With little in the way of influential UK data due for publication over the rest of this week, additional movement in the Pound (GBP) exchange rate is likely to occur in response to global economic developments.

Pound (GBP) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,US Dollar,1.7144,

,US Dollar,1.7144,

Pound Sterling, ,Euro,1.2555,

,Euro,1.2555,

Pound Sterling, ,Australian Dollar,1.8298,

,Australian Dollar,1.8298,

Pound Sterling, ,New Zealand Dollar,1.9578,

,New Zealand Dollar,1.9578,

US Dollar, ,Pound Sterling,0.5833,

,Pound Sterling,0.5833,

Euro, ,Pound Sterling,0.7965,

,Pound Sterling,0.7965,

Australian Dollar, ,Pound Sterling,0.5467,

,Pound Sterling,0.5467,

New Zealand Dollar, ,Pound Sterling,0.5109,

,Pound Sterling,0.5109,

[/table]

Comments are closed.