The Japanese Yen is on course to make its first back-to-back weekly gain in more than three-months as demand for the currency was bolstered by demand for safer assets and as industrial production data was better-than-forecast.

The Yen began to advance against the US Dollar after Federal Reserve Chairman Janet Yellen said that the US economy still has some way to go before it can be classed a healthy one. Mixed data released yesterday also weighed upon the ‘Greenback’.

Against the Euro the Yen advanced to its best level in two months after yesterdays data out of the Eurozone disappointed investors and increased the odds that the European Central Bank will introduce new stimulus measures at next month’s policy meeting.

A deterioration in relations between Vietnam and China, ongoing tensions between the West and Russia regarding Ukraine and rioting in Turkey all dampened sentiment towards riskier assets.

“There are problems and I do think they will start to drain on sentiment in the next couple of months, and potentially the Yen will be one of the main beneficiaries. I’m a little but concerned that the US Dollar could break some levels to the downside and we get another sell-off,” said Derek Mumford, director at Rochford Capital, a currency risk-management company in Sydney.

Also supporting the Japanese Yen was the release of data which showed that industrial production in the country increased more than expected in March.

According to the year-on-year data production increased from Februarys reading of 7.0% to 7.4%, beating forecasts for a figure of 7%. On a monthly basis production advanced by 0.7% from the previous months fall of -2.3%.

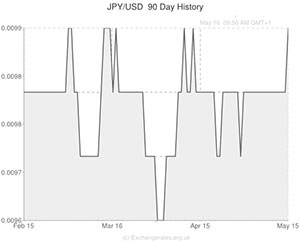

Japanese Yen (JPY) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

US Dollar, ,Japanese Yen,101.5700 ,

,Japanese Yen,101.5700 ,

Euro, ,Japanese Yen,139.3670 ,

,Japanese Yen,139.3670 ,

Pound Sterling, ,Japanese Yen,170.6040,

,Japanese Yen,170.6040,

Australian Dollar, ,Japanese Yen,94.9086 ,

,Japanese Yen,94.9086 ,

[/table]

Comments are closed.