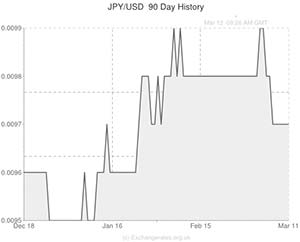

The Japanese Yen strengthened for a third consecutive day against the US Dollar and Euro as worries over the ongoing political standoff in Ukraine and the recent weak trade data out of China bolster demand for the safe haven currency.

The Yen is forecast to climb higher against all of its major peers today as economists await the release of retail sales and factory output data from China.

If the data disappoints we can expect demand for the Yen to be bolstered even more and currencies such as the Australian Dollar will fall.

“When you get disappoint data out of the world’s second-biggest economy, that’s going to be something that could dampen market sentiment. Looking at Treasury yields today, they’re a little bit lower, and that’s something that’s going to weigh on the USD/JPY pair as well,” said a currency strategist at Wells Fargo & Co.

Also providing support to the Japanese Yen is the ongoing political standoff between the West and Russia over the Crimea and Ukraine. Threats of economic sanctions being imposed upon Russia increased today as Germany told the Russians that they must withdraw from the Crimea by next week or risk harsher sanctions.

The situation was little helped after Ukraine’s deposed President warned that civil war could occur in the nation.

Ukraine’s interim Prime Minister Arseniy Yatsenyuk is due to travel to the United States to meet President Barack Obama on Wednesday, as diplomatic efforts to resolve the crisis continued.

Current Japanese Yen (JPY) Exchange Rates:

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

US Dollar, ,Japanese Yen,102.8700 ,

,Japanese Yen,102.8700 ,

Euro, ,Japanese Yen,142.4920 ,

,Japanese Yen,142.4920 ,

Pound Sterling, ,Japanese Yen,170.8300 ,

,Japanese Yen,170.8300 ,

Australian Dollar, ,Japanese Yen,92.1420 ,

,Japanese Yen,92.1420 ,

[/table]

Comments are closed.