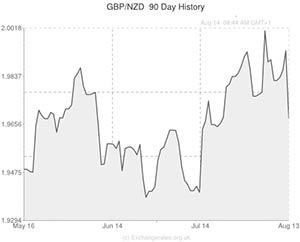

The Pound to New Zealand Dollar exchange rate (GBP/NZD) weakened by a whopping -2.5 cents yesterday to reach a 3-week low of 1.9662.

Whilst the first 2 cents of the ‘Kiwi’ Dollar’s gains were brought about by soft wage growth in Britain and a slight modification to the Bank of England’s forward guidance policy the final half-cent came in reaction to a stronger-than-expected New Zealand retail sales report.

The fastest acceleration of motor vehicle sales in two years helped drive the New Zealand retail sales index up from 0.8% to 1.2% during the second quarter, beating the median market consensus of 1.0%. The upbeat private consumption figures boosted demand for the ‘Kiwi’ Dollar despite the Reserve Bank of New Zealand’s recent announcement that it has decided to pause its interest rate hiking cycle.

Disastrous wage growth sours Sterling sentiment

The majority of GBP/NZD’s heavy losses were caused by yesterday morning’s UK labour market report, which showed that average earnings slipped to a 5-year low of -0.2% in the second quarter. The dismal figure means that not only are wages falling on a ‘real’ basis (relative to inflation)’ they are also falling on a nominal basis – something that hasn’t happened since 2009.

The headline unemployment rate actually improved, printing at 6.4% down from 6.5%. However, traders largely ignored this positive development, instead choosing to focus on Britain’s downbeat earnings data.

The significance of the negative average earnings result was enhanced later on in the morning yesterday when Bank of England Governor Mark Carney said that the Monetary Policy Committee (MPC) will be monitoring the path of wage growth with increased scrutiny from now on as policymakers decide when to start raising interest rates.

The latest bank forecasts for 2014 saw GDP growth upgraded from 3.4% to 3.5%, inflation upgraded from 1.8% to 1.9% and unemployment revised down from 6.3% to 5.9%. However, these projections work under the assumption that the first increase in interest rates will take place in February 2015, a full three months later than most traders had expected prior to yesterday’s dovish report.

This shows that GDP, inflation and unemployment are all currently at levels deemed appropriate for monetary tightening by the BoE. This means that further positive developments in these indicators may not have as strong an impact on demand for the Pound as it has done over the past 12 months.

Worryingly, the bank’s wage growth projection for 2014 was slashed in half from 2.50% to 1.25%. With inflation set to be 0.65% higher than average earnings by the end of the year it is possible that the BoE might delay its first rate hike by a little bit longer. With this in mind it looks entirely likely that Sterling could tumble further against the New Zealand Dollar (GBP/NZD) over the next few weeks and months if wage growth does not pickup markedly in the near future.

Comments are closed.