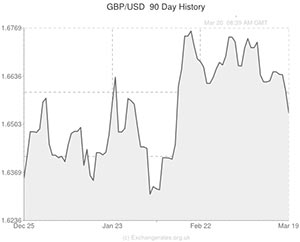

The Pound to US Dollar exchange rate (GBP to USD) plunged by around a cent yesterday evening as the Federal Reserve announced that it was tapering asset purchases by a further -$10 billion in March.

Following previous stimulus reductions in December and January, the pace of monthly QE3 purchases currently stands at $55 billion.

The ‘Greenback’ also benefited from Fed Chair Janet Yellen’s comments on raising interest rates. Yellen indicated that rates could be hiked as little as 6 months following the end of QE3, which caused markets to price-in a tightening of monetary policy in April 2015.

Yellen’s language was fairly nebulous, but the fact of the matter is that investors now expect a rate hike to come sooner than they did before, and this bolstered demand for the US Dollar.

The Pound had previously rallied by around 0.4 cents against the US Dollar as a positive stream of data during the London session boosted sentiment towards Sterling.

The GBP to USD exchange rate rallied in reaction to the announcement that Jobless Claims fell by -34,600 during February, which was a better figure than the market consensus of -25,000. Sentiment was also boosted by a 105,000 increase in the number of people in employment and a surprise 1.4% increase in Average Weekly Earnings, as measured over a three month period. The headline three month running Unemployment Rate remained steady at 7.2%.

However, on a monthly basis wages were seen to have increased by 1.7% and the jobless total came in at a vastly improved 6.9%. With monthly wages approaching the rate of inflation (1.9%), it is possible that real wages could finally begin to rise over the next few months – something that has not happened since 2009. This would probably lead to an increase in consumer spending, which, accounting for around 70% of the UK economy, would most likely lead to an acceleration of Gross Domestic Product.

The monthly Unemployment Rate of 6.9% is particularly interesting because it is lower than the Bank of England’s original 7.0% threshold for considering hiking interest rates. However, since Governor Mark Carney’s decision to broaden the Bank’s forward guidance it is now believed that it would take a jobless rate of 6.5%, among other things, to persuade the Monetary Policy Committee to raise rates.

The Pound was also given a mild boost by Chancellor of the Exchequer George Osborne’s 2014 Budget, which featured an optimistic GDP upgrade for the current year. Compared to previous estimates of 2.4%, it is now forecast that the British economy will expand by 2.7% during 2014.

Comments are closed.