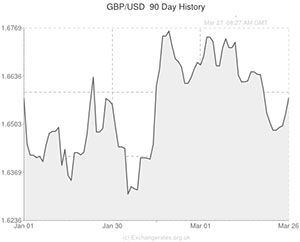

The US Dollar was little changed against the Pound on Thursday as the UK currency remained supported by the morning’s positive retail sales data, leaving the GBP to USD exchange rate at 1.6627.

The USD to Euro exchange rate advanced to a session high after the release of positive jobless claims and GDP growth data.

According to the Commerce Department, US GDP climbed by 2.6% at an annualised rate in the final quarter of last year, better than the 2.4% gain reported in February. Economists had been calling for a figure of 2.7%.

The report showed that personal spending was revised up to 3.3% from 2.6% initially, the fastest rate of growth in three years.

The increase was accredited to increased consumer spending in the healthcare sector. The winter’s harsh weather is thought to have restrained GDP growth so expectations are high that the next reading will be stronger.

A separate report showed that the number of US citizens applying for unemployment benefits fell unexpectedly last week to come close to a four-month low, suggesting that confidence amongst US companies is growing.

According to the Labour Department, the number of people making jobless benefit claims fell by 10,000 to 311,000 in the week ending on March 22nd. Economists had been expecting the number to come in at 323,000.

Further gains were restricted however by data showing that the number of pending home sales in the USA fell to the lowest level since October 2011. According to the National Association of Realtors its pending home sales index fell by 0.8% to 93.9 in February suggesting that the housing market is continuing to struggle with the harsh winter weather. Economists are expecting the next report to show a reversal as spring begins.

US Dollar (USD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

US Dollar, ,Pound Sterling,0.6014 ,

,Pound Sterling,0.6014 ,

US Dollar, ,Euro,0.7264 ,

,Euro,0.7264 ,

US Dollar, ,Australian Dollar,1.0828 ,

,Australian Dollar,1.0828 ,

US Dollar, ,Canadian Dollar,1.1083 ,

,Canadian Dollar,1.1083 ,

Pound Sterling, ,US Dollar,1.6627 ,

,US Dollar,1.6627 ,

[/table]

Comments are closed.