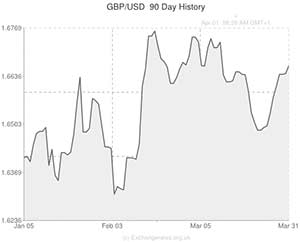

The Pound to US Dollar exchange rate (GBP to USD) surged to a fresh fortnightly high in the region of 1.6680 yesterday afternoon as investors reacted sharply to a speech from Federal Reserve Chairwoman Janet Yellen.

A couple of weeks ago Yellen suggested that interest rates could be raised in America just six months after quantitative easing is stopped. This surprisingly short timeframe sent investors piling into the safe haven US Dollar under the impression that the ‘Greenback’ would benefit from increased yield values some time around April next year. GBP/USD tumbled by over a cent.

However, the Fed President opted to make a partial retraction of those comments yesterday by means of stressing the US Central Bank’s commitment to support economic growth through ultra low interest rates. Yellen stated that low borrowing costs are vital in the Fed’s quest to support lending into the real economy and spur business investment.

She described the recent tapering of asset purchases as “a judgement that recent progress in the labour market means our aid for the recovery need not grow as quickly”, and underlined that the Fed remains committed to provide “extraordinary support for the recovery for some time to come”.

GBP to USD rallied by around half a cent from 1.6620 to 1.6675 in the aftermath of the speech as markets factored in the Fed’s softening of rate hike rhetoric.

Earlier in the day the Pound suffered a minimal drop in demand as UK Mortgage Approvals slid from 76,800 to 70,300 and the US Dollar gave up some ground as the US Chicago Purchasing Managers Index decelerated considerably from 59.8 to 55.9. The Janet Yellen comments commanded more market volatility than either of these two data releases.

Later today UK Manufacturing is expected to print at 56.5, showing a mild deceleration from 56.9. Any figure above 57.0 could lend Sterling a leg-up.

The US Manufacturing PMI is predicted to rise from 53.2 to 54.0, however, with the Chicago PMI coming in around four points lower-than-anticipated it is possible that the headline stat could also undershoot the market consensus, which would most likely damage sentiment towards the ‘Greenback’.

The next major release for the currency pair is Friday’s US Non-farm Payroll report. In the absence of any major underwhelming or outperforming UK or US ecostats, it is likely that the American labour report will pave the way for future GBP/USD direction.

A score of 200,000 is expected for March, which could bolster support for the US Dollar, however, anything below February’s 175,000 has the potential to derail the Dollar as it would signify that the inclement weather during the first few months of the year may not be fully culpable for the lull in economic output.

Comments are closed.