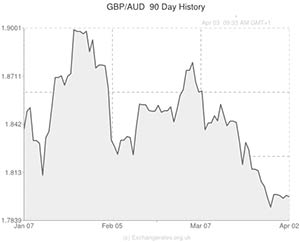

The GBP to AUD exchange rare was stronger on Thursday due to the release of weaker than forecast domestic data out of Australia and as the markets grew increasingly jittery ahead of the European Central Bank policy meeting.

Despite a rise in Australian retail sales the currency was unable to continue it’s upwards momentum. Sales rose by 0.2% in February, below economist forecasts for a rise of 0.3%. The figure also showed that sales slowed markedly from the 1.2% rise recorded in the first month of the year.

The ‘Aussie’ was softened further after a separate report showed that Australia’s trade surplus narrowed in February to A$1.20 billion, down from the A$1.39 billion surplus seen in January. Economists had been expecting the trade surplus to narrow to A$0.82 billion in February.

Investors were also cautious after Reserve Bank of Australia Governor Glenn Stevens said in a speech at the American Chamber of Commerce that it was still too early to see whether a handover from mining investment to domestic-led growth will happen smoothly.

“There are some promising early signs that things may turn out not too badly…but early signs are just that, early. It is far too soon to think about counting any chickens yet,” Stevens said in his address.

The Australian Dollar is expected to weaken further over the coming sessions as economists look to important data releases due out of the USA and Europe. If Friday’s non-farm payrolls data comes in strongly then we can expect the ‘Aussie’ to weaken.

Australian Dollar (AUD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Australian Dollar, ,US Dollar,0.9227 ,

,US Dollar,0.9227 ,

Australian Dollar, ,Pound Sterling,0.5543 ,

,Pound Sterling,0.5543 ,

Australian Dollar, ,Euro,0.6697 ,

,Euro,0.6697 ,

Australian Dollar, ,New Zealand Dollar,1.0796 ,

,New Zealand Dollar,1.0796 ,

[/table]

Comments are closed.