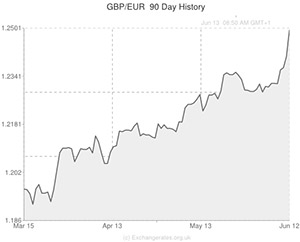

The GBP to Euro exchange rate achieved a 19-month high of 1.2518 after recovering earlier losses as Bank of England rate hike speculation went through the roof.

At last week’s BoE policy meeting the central bank opted to leave interest rates unaltered and the level of bond buying unchanged, as expected by economists. The institution has maintained for the last few months that the level of slack in the UK economy justifies holding interest rates at record lows for some time.

However, the resilience of the domestic housing market is becoming an issue and the rapid pace of the UK’s economic recovery is making it increasingly likely that the BoE may need to hike borrowing costs before the spring of 2015 (the date previously hinted at as the period for the first increase).

Yesterday BoE Governor Mark Carney abandoned his usually dovish stance and asserted that various factors could contribute to interest rates being gradually increased ‘sooner than markets currently expect.’

His insinuations caused something of a stir in the currency market and pushed the Pound to its strongest level against the Euro since the tail end of 2012.

In reference to the housing market Carney stated;’The FPC is considering using macroprudential tools to insure against potential vulnerabilities associated with the housing market. The value of acting early is reinforced by uncertainty around the precise impact of macroprudential tools.’

The Pound was also able to hit a high of 1.6936 against the US Dollar.

The Cable’s bullish relationship was aided by Thursday’s slightly disappointing US advance retail sales figures. While sales growth of 0.6 per cent had been anticipated, retail sales in the world’s largest economy only increased by 0.3 per cent on the month – though this did follow a revised sales gain of 0.5 per cent in April.

As the day continues further volatility in the GBP to Euro pairing could be inspired by the UK’s construction output report and the Eurozone’s trade balance figures. Today’s final German inflation figures for May confirmed that consumer prices fell by 0.1 per cent on the Month and rose by just 0.9 per cent on the year. Italy’s CPI figures are due out this morning.

Investors with an interest in the GBP to USD exchange rate will also be focusing on the University of Michigan confidence index. If the gauge rises to 81.9 from 83.0 as forecast the ‘Greenback’ may recoup some of its losses before the weekend. The US producer price index is due out at 13:30.

GBP to Euro & USD Update – 13/06/2014 16:25

Over the course of the European session the Pound continued trading in the region of a 19-month high against the Euro in spite of separate reports showing that the Eurozone’s trade balance widened and the region’s employment level rose. Sterling was riding high thanks to BoE Governor Mark Carney’s more bullish attitude and retained these gains as domestic construction output increased by more than anticipated in April. Construction output in the UK rebounded from a month-on-month decline of 0.2 per cent in March by expanding 1.2 per cent in April.

The GBP to USD pairing, meanwhile, closed in on a five-year high as US reports fell short of expectations. The US wholesale price index fell by more than anticipated while the University of Michigan Confidence Index slipped rather than increasing to 83.0 as projected. The slightly disappointing results add to the case for the Federal Reserve leaving interest rates on hold and come just before next week’s Federal Open Market Committee meeting.

The Pound’s current strength could last into next week if UK reports (like the nation’s retail sales figures) surprise to the upside.

Pound (GBP) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,US Dollar,1.6952,

,US Dollar,1.6952,

Pound Sterling, ,Euro,1.2527,

,Euro,1.2527,

Pound Sterling, ,Australian Dollar,1.8062,

,Australian Dollar,1.8062,

Pound Sterling, ,New Zealand Dollar,1.9600,

,New Zealand Dollar,1.9600,

US Dollar, ,Pound Sterling,0.5894,

,Pound Sterling,0.5894,

Euro, ,Pound Sterling,0.7985,

,Pound Sterling,0.7985,

Australian Dollar, ,Pound Sterling,0.5536,

,Pound Sterling,0.5536,

New Zealand Dollar, ,Pound Sterling,0.5102,

,Pound Sterling,0.5102,

[/table]

Comments are closed.