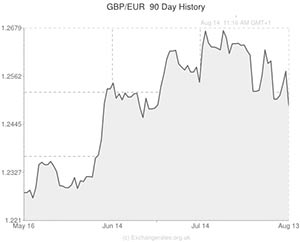

The Pound to Euro (GBP/EUR) exchange rate was trading in the region of 1.246 on Thursday after the UK currency was significantly weakened after Bank of England Governor Mark Carney said that officials were in no rush to raise interest rates.

Wednesday’s disappointing UK wage growth data caused bets for a rate rise to fall, which in turn sent the Pound tumbling to a four-month low against the US Dollar (USD) and below the 1.25 level against the Euro.

The wage data caused the gap between the exchange rate and analysts end of year forecasts to widen to its largest extent since July 2013.

Economists blamed Mr Carney for not being clear enough with his reports and accused him of back peddling after saying in June that the BoE could raise rates sooner than the markets were expecting.

‘I don’t know if we’ve misinterpreted him or taken him too literally, but the market has allowed itself to be led a merry dance on rate expectations.

The Pound is following those expectations pretty faithfully,’ said an economist in a telephone interview with Bloomberg.

The Euro made little movement against its peers despite the release of data, which showed that the Eurozone economy failed to expand in the second quarter of the year.

GDP came in at 0.0%, disappointing expectations for a slight rise of 0.1%.

Worryingly for the single currency region, the German economy posted a surprise contraction of 0.2%, the nation’s first contraction since 2012.

France saw its economy stagnate and it was confirmed that Italy fell into its third recession since 2008 with GDP contracting by 0.2%.

There were some positives from the report however as Spain posted its fastest rate of expansion since 2007 and the Netherlands returned to growth.

Economists blamed the geopolitical concerns raised by the Ukraine crisis for the poor performance and blamed a mild winter for a reduction in fuel demand in the north of the 18-member region.

‘With the geopolitical tensions not cooling down for the time being, there is little likelihood that the growth of pace will accelerate in the second half of the year. The European Central Bank is likely to stand pat for the remainder of the year. Big decisions on more unconventional policy measures will have to await 2015,’ said Peter Vanden Houte, chief Eurozone economist at ING Groep.

A separate report showed that the annual rate of inflation in the 18-member currency bloc came in at 0.4% in July, matching analyst expectations and was unchanged from the preliminary estimate.

With the Eurozone stalling and the threat of the Eurocrisis resurfacing in force pressure is now building upon ECB President Mario Draghi to take action to try to revive growth and tackle the threat of deflation.

As Germany posted a surprise contraction, some market observers now believe that the country could ease its opposition to the ECB introducing a quantitative easing programme.

‘The Eurozone is staring recession in the face once more. This exceptionally weak data increases the pressure on Mario Draghi to make good his pledge to “do whatever it takes” and finally embark on a quantitative easing programme. Germany has always been a notable opponent to quantitative easing – Bundesbank Chief Jens Weidmann said this week that the responsibility for stimulating growth lies with individual member states rather than the ECB – but perhaps today’s shock GDP contraction will lead to a softening in this stance,’ warned Ben Bretell, senior economist at Hargreaves Lansdown.

Pound to Euro Exchange Rate Forecast

The Pound could regain some ground against the single currency on Friday if GDP data for the UK comes in strongly.

The currency is widely forecast to regain strength if data releases continue to show that the UK economy is continuing to strengthen.

Economists are expecting year on year GDP to expand from 3.0% to 3.1% and quarter on quarter to come in at 0.8%.

GBP to Euro Strengthens Fractionally on Positive GDP Data

Yesterday the Pound to Euro exchange rate continued to soften despite less-than-impressive European Gross Domestic Product (GDP) data. This was due to overwhelming negative sentiment towards Sterling following the weak labour market data and a dovish BoE inflation report.

Today should see the GBP/EUR exchange rate strengthen as traders digest the poor European GDP data. With nothing by way of European domestic data today it is likely that yesterday’s string of negative European GDP results will continue to mar trader sentiment.

The UK GDP data should also help to bolster the Pound as it met with forecast figures for the quarter-on-quarter report, and exceeded expectation for the year-on-year GDP report.

Euro Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Euro, ,US Dollar,1.3389 ,

,US Dollar,1.3389 ,

Euro, , Pound Sterling,0.8025 ,

, Pound Sterling,0.8025 ,

Euro, ,Australian Dollar,1.4364 ,

,Australian Dollar,1.4364 ,

Euro, ,Canadian Dollar,1.4566 ,

,Canadian Dollar,1.4566 ,

Pound Sterling, ,Euro,1.2469 ,

,Euro,1.2469 ,

US Dollar, ,Euro,0.7237 ,

,Euro,0.7237 ,

[/table]

Comments are closed.