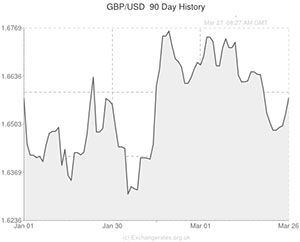

Although the ‘Greenback’ did not react strongly to Federal Reserve policymaker Charles Plosser’s comments yesterday, the Pound to US Dollar exchange rate (GBP/USD) is forecast to fall over the next few months.

Yesterday afternoon Plosser made a series of hawkish remarks in an interview on Fox News. The Philadelphia Fed President predicted that US Unemployment will fall to 6.0% by the end of the year. He suggested that the Fed’s quantitative easing scheme should be fully wound down this autumn and mentioned that he would like to see inflation rise towards the 2.0% target over the medium term.

GBP to USD slid mildly, by around 20 pips, to 1.6560 in reaction to Plosser’s upbeat appraisal. However, Sterling still managed to hold onto daily gains of around a third of a cent.

Earlier on in the week Plosser forecast that the Fed funds rate would grow to 3.00% by the end of 2015 and to 4.00% by the end of 2016. The benchmark interest rate currently stands at an all-time record low of 0.25%.

In terms of concrete economic data yesterday: UK traders were starved but there were a few nuggets of news related to the American economy.

US Durable Goods Orders grew by 2.2% during February, up from -1.3% in January. Durable Goods are defined as items designed to last for over three years. These are usually expensive purchases and as such they often plummet in volume during times of economic uncertainty. January’s -1.3% contraction was likely a consequence of the polar vortex but it seems that confidence returned last month, as evidenced by the rebound in orders.

It was also reported that tertiary output in the world’s largest economy pushed on from 53.3 to 55.5 this month. Markit’s Composite PMI of Manufacturing and Services activity also improved, from 54.1 to 55.8, however, the ‘Greenback’ was unable to build up any momentum against the Pound.

Data released later today is expected to show that UK Retail Sales improved at an annual rate of 2.9% during February, which should give Sterling a slight boost. However, GBP/USD could struggle to break above 1.6600 because annualised US GDP is anticipated to be upgraded from 2.4% to 2.7% and Initial Jobless Claims are forecast to print positively at 325,000.

Sterling has managed to pull away from crucial technical support at 1.6475 over the last few days, however, with Fed policymakers keen to shutdown the QE3 programme and start a hiking cycle by spring next year, it is possible that GBP/USD could soften over the coming months.

Comments are closed.