The Euro fell against all of its major peers yesterday after the European Central Bank introduced a range of measures designed to bolster the Eurozone economy and weaken the currency.

Rather than see a rapid fall against peers such as the Pound and US Dollar the Euro remained stubbornly high as traders continued to purchase the currency after ECB President Mario Draghi unveiled a cut to the regions interest rate and introduced stimulus measures such as the introduction of a negative deposit rate.

Traders were speculating that the ECB’s actions will bolster the Eurozone’s stock and bond markets which in turn improved their appeal and the currency needed to buy them.

“The magnitude and multi-faceted nature of the stimulus suggests that the ECB’s main goal here is to take a chainsaw to the Euro, but the markets are just laughing at Draghi’s slasher mask,” said Guy LeBas, a strategist at Janey Montogomery Scott LLC in a note to clients.

Today the Euro was weakened as investors sought higher yielding assets elsewhere. As a result currencies such as the Australian and New Zealand Dollars were finding strong support as investors favoured the nation’s higher interest rates and better yields. Riskier assets such as the South African Rand also benefitted.

Further gains for the Pound against the Euro were restrained somewhat by the release of positive data out of Germany.

Official data released earlier in the session showed that Germany’s trade surplus widened to €17.7 billion in April, from the €15.0 billion seen in March, that figure was revised up from a previously estimated surplus of €14.8 billion. Analysts had expected the trade surplus to widen to €15.2 billion in April.

The Pound meanwhile came under pressure after a report showed that the UK’s trade deficit widened more than expected in April.

Euro Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Euro, ,US Dollar,1.3640 ,

,US Dollar,1.3640 ,

Euro, , Pound Sterling,0.8106 ,

, Pound Sterling,0.8106 ,

Euro, ,Australian Dollar,1.4581 ,

,Australian Dollar,1.4581 ,

Euro, ,Canadian Dollar,1.4891 ,

,Canadian Dollar,1.4891 ,

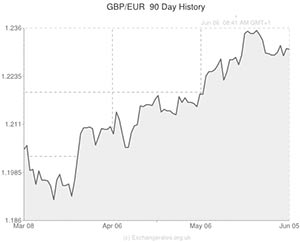

Pound Sterling, ,Euro,1.2334 ,

,Euro,1.2334 ,

US Dollar, ,Euro,0.7332 ,

,Euro,0.7332 ,

[/table]

Comments are closed.