As the weekend rumbled closer the Euro to Pound exchange rate softened by 0.11% in response to disappointing confidence data from the Eurozone.

The Euro also lost 0.25% against the US Dollar as the European session progressed.

For much of Friday the Euro to GBP pairing was trading in a narrow range.

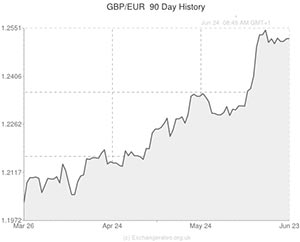

The Pound managed to hold above 1.25 for much of the day in spite of the Eurozone publishing data which showed that the region’s current account surplus was wider than expected in April.

Earlier in the day the Euro had come under a little pressure as German producer prices were shown to have flopped by 0.2% last month (on a month-on-month basis) rather than stagnating as economists had forecast. This followed a 0.1 per cent month-on-month decline in April.

On the year, prices were down by 0.8 per cent in May – a slight improvement on April’s annual drop of 0.9 per cent but a larger fall than the 0.7 per cent decline forecast.

The monthly decline was the tenth in a row and adds to the price-pressure concerns already piling on the Eurozone.

UK data, meanwhile, revealed a widening in the nation’s budget deficit. The shortfall came in at 13.3 billion Pounds in May, more than the 12.2 billion Pounds forecast and up from a deficit of 12.6 billion Pounds the previous year.

However, the Euro to GBP exchange rate went on to decline by a modest amount as investors responded to a fairly disappointing economic report from the Eurozone.

According to the latest figures, the Eurozone’s gauge of consumer confidence declined from -7.1 in May to -7.4 in June rather than rising to -6.5 as predicted.

The level of consumer confidence recorded last month was the strongest in six and a half years and economists were hoping for another upbeat result.

However, since then the European Central Bank has introduced unprecedented stimulus measures and the situation in Iraq has become increasingly concerning.

The Euro was also feeling the pressure after the International Monetary Fund asserted that the recovery in the 18-nation currency bloc is ‘neither robust nor sufficiently strong’.

The IMF also stated; ‘If inflation remains stubbornly low, the European Central Bank should consider a large-scale asset purchase programme. This would boost confidence, improve corporate and household balance sheets and stimulate bank lending’.

While action of this sort would certainly boost the Eurozone’s economy, it would drive the Euro lower and some leading ECB officials feel that such measures aren’t necessary yet.

ECB Executive Board Member Benoit Coeure was quoted as saying; ‘there is no disagreement with the IMF. We’ve been clear in case inflation would be too low for too long, we can use additional instruments […] it is in the toolbox, but it is not needed today. I don’t think the IMF would disagree with that.’

Updated:10:00 GMT on Sunday 21st June

Next week the Euro to Pound exchange rate could continue trending in close to a 19-month low if the UK’s economic reports impress. While highly influential UK data is thin on the ground, investors will be taking an interest in both Hometrack and Nationwide housing data.

As concerns regarding the UK’s overheating housing sector is one of the main arguments in favour of the BoE introducing a rate increase this side of Christmas, if this week’s house price figures show another strong month-on-month surge in the value of properties the odds of a rate hike could climb and the Pound could be boosted.

Monday also sees the publication of manufacturing and services PMI reports for the Eurozone and its largest economies. If France (referred to recently as the ‘poor man of Europe’) releases another batch of disappointing results, Euro losses can be expected.

EUR/GBP- Euro strengthens as Pro-Russian Separatists ceasefire eases worries over Ukraine

The Euro moved away from its recent lows against the Pound on Tuesday as investors embarked on a bout of profit taking of the UK currency.

The single currency made gains despite the release of data which showed that business sentiment in the Eurozone’s largest economy fell more than expected in June.

According to data the IFO business climate index dropped to its lowest level in six-months.

Despite that the Euro was able to gain some ground against a number of peers.

Aiding the currency was yesterday’s news that Pro-Russian rebels in eastern Ukraine had called a cease fire, matching the one called earlier in the week by the Ukrainian government.

The separatists’ decision raised hopes that the situation could ease the crisis that has resulted in hundreds of deaths and brought the worst standoff between the West and Russia since the days of the Cold War.

Comments are closed.