The Euro edged higher to pull away from session lows against the Pound and US Dollar due to the release of fairly positive data out of Spain. Gains were restrained however as eagerly anticipated Eurozone inflation data came in below economist forecasts.

Early in the session the Euro had been under pressure as investors grew jittery ahead of the inflation report. Tensions eased somewhat after data out of Spain showed that the nation posted better-than-expected GDP and inflation data. Adding support to the currency was a separate report which showed that unemployment in Germany held steady in March.

Eurozone consumer price growth increased less than expected in April restraining the Euro’s movements.

According to the European Union Statistics office, annual inflation increased to 0.7% in April, up from March’s figure of 0.5%. The figure was below the 0.8% rise forecast by economists. The figure remains well below the European Central Banks target of just under 2% and is likely to put further pressure upon the Central Bank to introduce new easing policies such as negative interest rates and quantitative easing.

Despite the weaker-than-expected figure several analysts believe that the figure was high enough to not warrant action by the ECB.

“The lower than expected Eurozone inflation reading for April will fuel speculation of further monetary easing by the ECB at next week’s policy meeting. However, we doubt whether the ECB will pull the trigger just yet,” said ING’s Martin Van Vliet.

The slight rise in inflation was partly due to less negative energy price inflation (-1.2% versus -2.1%), but also reflected a sharp increase in the core rate, from 0.7% to 1.0%. Food, alcohol and tobacco inflation eased from 1.0% to 0.7%.

Attention will now shift to Friday’s upcoming Eurozone unemployment data. The report could provide further insight into what the ECB will do at next week’s policy meeting.

Euro to Pound Update 01/05/14

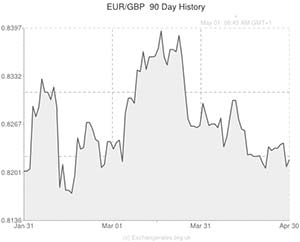

The Pound softened against the Euro on Thursday amongst speculation that investors were trimming their bets that the European Central Bank will introduce measures to tackle the threat of low inflation in the Eurozone at next week’s policy meeting. The Euro to Pound exchange rates (EUR/GBP) is currently trading around 0.8225.

Yesterday’s anticipated inflation data came in just below economist forecasts but was an improvement on the previous release. According to Eurostat, inflation increased from the 0.5% reading seen in March to 0.7% in April. The rise was below economist expectations but was seemingly enough to ease pressure upon the ECB.

Euro Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Euro, ,US Dollar,1.3825 ,

,US Dollar,1.3825 ,

Euro, , Pound Sterling,0.8221 ,

, Pound Sterling,0.8221 ,

Euro, ,Australian Dollar,1.4891 ,

,Australian Dollar,1.4891 ,

Euro, ,Canadian Dollar,1.5146 ,

,Canadian Dollar,1.5146 ,

Pound Sterling, ,Euro,1.2163 ,

,Euro,1.2163 ,

US Dollar, ,Euro,0.7233 ,

,Euro,0.7233 ,

[/table]

Comments are closed.