The Euro had a relatively quiet week last week due to the market being subdued as a result of the New Year and Christmas holidays. Many traders and investors were taking their end of year break so any movement was exaggerated due to the lack of liquidity in the market.

At the start of the week the single currency managed to push higher against the Pound due to the release of better-than expected data out of Spain. The country has begun to show signs of improvement with the majority of recent data releases coming in better than forecast, as a result optimism that the Eurozone recovery could be seeing something of a revival.

The market was shut on New Year’s Day but there was some news for the Eurozone in the form of Latvia becoming the 18th member of the currency union.

When the market reopened the Euro found itself weaker against the Pound as France once again caused concern. The regions second largest economy is showing signs of decline.

Factory output fell hit a seven-month low and the decline in new orders was the fastest decline seen since June 2013. The data also highlighted that its manufacturing PMI was worse than Greece’s.

The Euro weakened against the Pound and a number of other currencies on Friday as the market were hit by a case of the jitters following the publication of data which showed that private lending in the currency bloc plunged to a record low in November.

A European Central Bank report showed that lending to the private sector in the Eurozone tumbled at its sharpest rate since records began over 20 years ago in November. The data suggests that the region will see its economic recovery could come under heavy pressure in 2014.

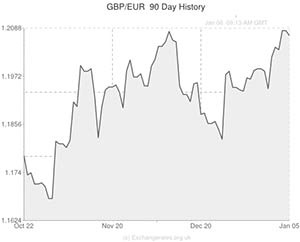

Looking ahead to this week we forecast that the GBP/EUR rate maintain its position in the region of 1.20. Sterling weakened after UK chancellor George Osborne said that more spending cuts are needed to introduce tax cuts. His comments weakened the Pound’s appeal.

The Euro took advantage of that after finding support from data which showed that Eurozone’s composite PMI came in better-than forecast. Services PMI on the other hand came in just under forecast.

Spain once again proved to be a bright point for the currency after its service sector registered its fastest pace of growth in six-and-a-half years in December, increasing expectations that the Spanish economy will expand more than expected in 2014.

This week also sees the release of PPI and inflation reports for the region. If inflation comes shows signs of decline then expect the Euro to fall as fears over the need for the European Central Bank to introduce measures to stave off deflation will once again rear its head.

A wealth of data is due for release midweek with all eyes focused on the Eurozone’s unemployment rate. Any increase will have a negative impact on the currency and knock confidence. Data out of France will also be of major concern and any weakness in those reports could drag the currency down.

Current Euro (EUR) Exchange Rates

The Euro/US Dollar Exchange Rate is currently in the region of: 1.3613

The Euro/Pound Sterling Exchange Rate is currently in the region of: 0.8330

The Euro/Australian Dollar Exchange Rate is currently in the region of: 1.5218

The Euro/ New Zealand Dollar Exchange Rate is currently in the region of: 1.6466

The US Dollar/Euro Exchange Rate is currently in the region of: 0.7345

The Pound Sterling /Euro Exchange Rate is currently in the region of: 1.2004

The Australian Dollar/Euro Exchange Rate is currently in the region of: 0.6569

The New Zealand Dollar/Euro Exchange Rate is currently in the region of: 0.6071

(Correct as of 09:45 am GMT)

Key events for the week ahead

Tuesday: German unemployment, Eurozone PPI, Eurozone inflation rate

Wednesday: Eurozone Retail sales, French retail sales, Eurozone unemployment rate

Thursday: Eurozone business confidence, Eurozone consumer confidence, Greek business confidence, German industrial production

Comments are closed.