Last week the Euro traded in a comparatively narrow range with peers like the Pound and US Dollar as investors focused on this week’s highly anticipated economic news.

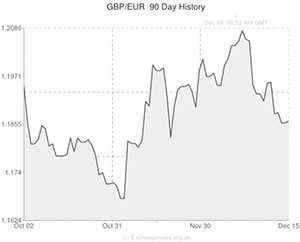

The Pound to Euro Exchange Rate is currently trading in the region of 1.1850 as of 10:50 GMT

Although the Euro did soften against the Pound in response to disappointing industrial output data for the Eurozone, the common currency recovered losses over the weekend and began local trading in a stronger position.

The Euro was also holding onto gains against the ‘Greenback’ ahead of Wednesday’s Federal Open Market Committee policy meeting.

If the Fed does opt to taper stimulus at the gathering the US Dollar could recoup declines against the Euro, although the prospect of a reduction in easing has largely been priced in.

Furthermore, the Euro was able to enjoy a relatively positive start to the week as economic reports for the Eurozone largely surprised to the upside.

Although measures of services output for both the Eurozone and Germany came in slightly below the levels expected, the manufacturing PMI for the currency bloc and its largest economy exceeded forecasts, coming in at 52.7 and 54.2 respectively.

The Eurozone composite PMI produced a reading of 52.1 in December, up from 51.7 in November and better than the 51.9 level expected.

In a statement accompanying the figures Markit economist Chris Williamson observed; ‘The rise in the PMI after two successive monthly falls is a big relief and puts the recovery back on track. The upturn means that, over the final quarter, businesses saw the strongest growth since the first half of 2011, and have now enjoyed two consecutive quarters of growth.’

The GBP/EUR Exchange Rate hit a low of 1.1821

While this result was certainly positive, Williamson did add; ‘However, it’s the unbalanced nature of the upturn among member states that is the most worrying. France looks increasingly like the new ‘sick man of Europe’ […] the sluggish nature of the upturn adds to the sense that policy will remain ultra accommodative for quite some time.’

As European trading continued the Euro received additional support as the Eurozone’s trade balance came in at 17.2 billion Euros in October, up from a negatively revised 10.9 billion in November.

With several major economic developments on the cards in the days ahead the Euro could be in for a volatile week.

Current Euro (EUR) Exchange Rates

< Lower > Higher

The Euro/US Dollar Exchange Rate is currently in the region of: 1.3767 >

The Euro/Pound Sterling Exchange Rate is currently in the region of: 0.8438 >

The Euro/Australian Dollar Exchange Rate is currently in the region of: 1.5360 >

The Euro/ New Zealand Dollar Exchange Rate is currently in the region of: 1.6651 >

The US Dollar/Euro Exchange Rate is currently in the region of: 0.7262 <

The Pound Sterling /Euro Exchange Rate is currently in the region of: 1.1850 <

The Australian Dollar/Euro Exchange Rate is currently in the region of: 0.6506 <

The New Zealand Dollar/Euro Exchange Rate is currently in the region of: 0.6015 >

(Correct as of 10:50 GMT)

Key events for the week ahead

Tuesday: Eurozone/German ZEW economic sentiment surveys

Eurozone CPI

Wednesday: German IFO business climate/current assessment/expectations reports

Thursday: Eurozone current account

Friday: German/Eurozone consumer confidence

Comments are closed.