The Pound rebounded against the majors yesterday as a surprisingly upbeat CBI Retail Sales report revitalised rate hike speculation. Sterling had fallen off the boil a little bit on Wednesday due to concerns from policymakers at the Bank of England that the latest fall in Unemployment could have underplayed the extent to which there is still slack in the labour market.

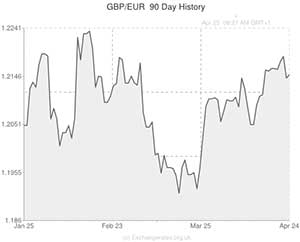

The Pound to Euro exchange rate (GBP/EUR) reached a daily high of 1.2162 and the Sterling to US Dollar exchange rate breached the psychologically significant level of 1.6800 in reaction to data released by the Confederation of British Industry showing that Retail Sales volumes jumped from +13 to +30 in April. The index had only been expected to rise to +17.

Sterling reacted well to the result because it was seen to bode well for this morning’s official Retail Sales report from the Office for National Statistics. The ONS figure is forecast to show a monthly deceleration of -0.4%, however, the actual result could be stronger if the surge in sales witnessed in the CBI report has a bearing on the official reading.

Consumer spending accounts for over 70% of the UK economy and therefore a better-than-expected ONS Retail Sales report could cause investors to adjust their predictions for when the Bank of England will start raising interest rates.

1.6843 would represent a fresh 4-year high for GBP to USD whilst 1.2258 would represent a fresh yearly high for GBP/EUR.

However, in light of Wednesday’s slightly dovish BoE Minutes report it could be difficult for Sterling to breach these levels. It is more likely that the Pound will rally mildly without actually striking any fresh yearly highs.

Sentiment in Europe remained fairly neutral yesterday: the German IFO for Business Climate improved from 110.7 to 111.2, but any optimism deriving from the result was tempered by comments from the European Central Bank President Mario Draghi, indicating that he is becoming increasingly serious about the prospect of loosening monetary policy in the Eurozone.

Across the pond in America a sturdy 2.6% acceleration in Durable Goods Orders was cancelled out by a disappointing 25,000 rise in Initial Jobless Claims. Compared to predictions of 315,000, the figure came in at 329,000.

Data released later this afternoon in the States is unlikely to have a massive impact on Pound to US Dollar: Market’s Service Sector PMI is forecast to rise from 55.3 to 56.0 and the University of Michigan’s Consumer Sentiment index is predicted to jump from 80.0 to 83.0.

The biggest threat for the Pound comes from the Retail Sales report. If the data disappoints it is possible that Sterling could struggle to find support during today’s session.

Comments are closed.