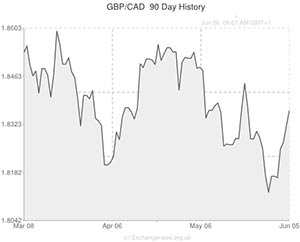

The GBP to CAD exchange rate is set to end the week on a high as the ‘Loonie’ broadly softened in reaction to unexpectedly poor Canadian employment figures.

Sterling had been stuck in static trading ranges for much of the day due to a lack of particularly influential economic news for the UK.

While the UK’s trade deficit was shown to have expanded by more-than-anticipated in April, some of the increase was the result of a Revenue and Customs omission in oil exports.

UK exports were shown to have fallen by 1.5 per cent in April while imports climbed by 0.8 per cent from March.

The disparity resulted in the deficit widening from the 8.3 billion Pounds recorded in March to 8.9 billion Pounds in April. Economists had envisaged a deficit of 8.7 billion Pounds. Even with the omission the Office for National Statistics put the deficit at 8.9 billion Pounds.

However, the Pound was later supported by the International Monetary Fund, who stressed that UK fiscal policy must be adapted to contain the nation’s surging house prices. Fears surrounding the UK’s overheating housing market could cause the Bank of England to reassess its timeline for hiking interest rates.

The Canadian Dollar meanwhile came under intensive pressure during the North American session. Although the ‘Loonie’, along with other higher-risk currencies, strengthened in the aftermath of the European Central Bank’s policy decision, it plummeted following the release of Canadian employment figures.

It had been expected that the Canadian economy would add 21,500 positions in May following a decline of 28,900 positions in April.

The nation actually added 25,800 jobs last month but as the participation rate held at 66.1 instead of rising to 66.2 the unemployment rate advanced from 6.9 per cent to 7 per cent. The jobs increase was largely due to rapid rise in part-time positions.

In the wake of the data publication economist David Watt noted; ‘You get the sense the Canadian economy is just fighting for momentum. You get open to the idea, despite inflation being at 2 per cent, maybe you have more credible discussion the next move by the bank could be a cut.’

As well as dropping by 0.25 per cent against the Pound the Canadian Dollar edged slightly lower against its US counterpart.

The US Dollar came under pressure of its own despite the fact that the US non-farm payrolls report showed that employment increased by slightly more than expected. Although NFP rose by 217,000 in May (2,000 more than anticipated) economists are betting that the result won’t be enough to convince the Federal Reserve to engage in an interest rate hiking cycle. The US unemployment rate held at 6.3 per cent in May and average hourly earnings were up more on the year than expected.

Next week Canadian Dollar movement could be caused by the nation’s housing starts, new housing price and manufacturing shipments reports.

The UK’s employment figures are also expected to provide a catalyst for GBP to CAD movement.

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5438,

,Pound Sterling,0.5438,

Canadian Dollar, ,US Dollar,0.9155,

,US Dollar,0.9155,

Canadian Dollar, ,Euro,0.6700,

,Euro,0.6700,

Canadian Dollar, ,Australian Dollar,0.9796,

,Australian Dollar,0.9796,

Canadian Dollar, ,New Zealand Dollar,1.0784,

,New Zealand Dollar,1.0784,

US Dollar, ,Canadian Dollar ,1.0923,

,Canadian Dollar ,1.0923,

Pound Sterling, ,Canadian Dollar,1.8392,

,Canadian Dollar,1.8392,

Euro, ,Canadian Dollar,1.4919,

,Canadian Dollar,1.4919,

Australian Dollar, ,Canadian Dollar,1.0213,

,Canadian Dollar,1.0213,

New Zealand Dollar, ,Canadian Dollar,0.9272,

,Canadian Dollar,0.9272,

[/table]

Comments are closed.