The Australian Dollar rallied from the lows it experienced early on Tuesday after top currency experts said that the benefits of a weaker ‘Aussie’ have been overstated. A survey showed that more than 50% of Australian businesses would prefer for the currency to remain trading above 90 US cents.

The currency began the session lower against the Pound, US Dollar, Euro and other major peers as concerns over a fall in iron ore prices weighed. News that Chinese authorities are planning to launch a crackdown on loans for iron ore imports spooked investors and caused prices to drop. Iron ore is Australia’s biggest export and China its largest trading partner.

Against the Pound the ‘Aussie’ joined the Euro is pushing higher after UK GDP data came in just below economist forecasts. According to data released by the Office for National Statistics the UK economy expanded by 0.8% instead of the 0.9% expected by economists.

The ‘Aussie’ pushed higher against Sterling and reversed its earlier declines against its other major peers after a business survey showed that just over 50% of businesses generating revenue of over $10 million would prefer the currency to remain above the US 90 cents level.

“We are not really looking for the currency to be a big driver of economic activity. There has been too much emphasis on it and there are other parts of the economy such as housing construction and consumption that are growing on the back of lower interest rates, without a materially weaker currency,” said the head of Australian and New Zealand fixed income and currency strategy at RBC Capital Markets.

The ‘Aussie’ could soften against the US Dollar later in the session if today’s US Consumer confidence data comes in strongly. Positive US data will weigh upon the ‘Aussie’. Against the Pound the currency is likely to remain in the 0.55 range.

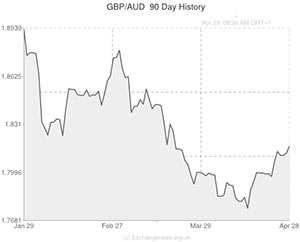

Australian Dollar Exchange Rate – Updated at 12:45 GMT on 30/04/2014

The Australian Dollar was able to strengthen against its counterparts overnight as investors rediscovered their appetite for higher-risk assets and currency market volatility waned ahead of today’s major reports.

After rallying against the Pound (GBP), US Dollar (USD) and Euro (EUR) on Tuesday, the ‘Aussie’ consolidated and extended gains during local trading.

While Australia’s private sector credit report had little impact on the nation’s currency, several recently published reports have indicated that the global economy is strengthening, and investors are celebrating the fact by investing in riskier assets like the Australian Dollar.

AUD/USD gains were also aided by yesterday’s disappointing US consumer confidence report, while the AUD/GBP was boosted by the news that the UK economy expanded by less-than-expected in the first quarter of 2014.

During Wednesday’s European session, the ‘Aussie’ was one of the few major currencies which managed to hold its own against the Euro. The common currency posted modest, but widespread, gains after inflation in the Eurozone was shown to have accelerated – albeit by less than economists had forecast.

In the hours ahead Australian Dollar volatility could occur in response to US growth data and the Federal Open Market Committee’s rate announcement, but investors will also be looking ahead to tomorrow and the publication of manufacturing data for Australia and China.

Australian Dollar (AUD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Australian Dollar, ,US Dollar, 0.9270,

,US Dollar, 0.9270,

Australian Dollar, ,Euro, 0.6704,

,Euro, 0.6704,

Australian Dollar, ,Pound, 0.5509,

,Pound, 0.5509,

Australian Dollar, ,New Zealand Dollar, 1.0854,

,New Zealand Dollar, 1.0854,

US Dollar, ,Australian Dollar, 1.0795,

,Australian Dollar, 1.0795,

Euro, ,Australian Dollar, 1.4890,

,Australian Dollar, 1.4890,

Pound Sterling, ,Australian Dollar, 1.8152,

,Australian Dollar, 1.8152,

New Zealand Dollar, ,Australian Dollar, 0.9221,

,Australian Dollar, 0.9221,

[/table]

Comments are closed.