The Pound dipped against most of the majors yesterday morning as investors reacted to a surprise drop in industrial and manufacturing production during May.

Analysts had predicted that both indicators would print at 3-year highs, with industrial production anticipated to accelerate at an annual rate of 3.2% and manufacturing output forecast to rise by a whopping year-on-year 5.6%.

However, the actual results signalled that industrial growth slowed from 2.9% to 2.3% and that manufacturing output cooled from 4.3% to 3.7%.

On a monthly basis the industrial sector contracted by -0.7% and manufacturing shrunk by -1.3%, making May the weakest month of manufacturing output for almost a year-and-a-half.

In an instant response to the disappointing data releases, Sterling plummeted against all of its most-traded currency peers, as investors considered the possibility that British growth is not on the pre-set course for strong expansion that many had begun to accept it was.

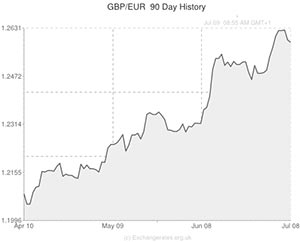

With Bank of England rate hike speculation in check, the Pound fell by -0.4 cents against the Euro (GBP to EUR), -0.5 cents against the US Dollar (GBP to USD), -0.6 cents against the Canadian Dollar (GBP to CAD), -0.7 cents against the Australian Dollar (GBP to AUD) and -1.2 cents against the New Zealand Dollar (GBP to NZD).

However, Sterling clawed back some/most of its losses versus the majors later on in the day as traders recovered from the initial shock of the weak figures.

Recent PMI surveys have signalled that sub indexes for employment, output and new orders are increasing rapidly in the manufacturing sector and a report released during the afternoon from the National Institute of Economic and Social Research (NIESR) suggested that British GDP accelerated from 0.8% to 0.9% in the second quarter.

If UK data continues to improve in the same manner as the aforementioned indicators then it is highly likely that the economy will expand rapidly in the near/medium term.

Another reason that the Pound recovered most of its losses from the soft production reports is that interest rate speculation, which drives demand for Sterling, is strongly linked to the UK housing market. And with British house prices currently rising at an exponential pace it is relatively unlikely that the Bank of England will refrain from hiking interest rates just because industrial production shrunk unexpectedly during one month.

As long as future UK economic indicators follow the positive trend that we have witnessed over the past 12 months then it is entirely likely that yesterday’s soft figures will be relegated to the category of anomalous insignificance and Sterling will continue to push for fresh multi-year highs against the single currency and the ‘Greenback’.

On the other hand, a run of poor results could lead to a reversal of the Pound’s bullish run against the Euro and (more likely) the US Dollar.

Comments are closed.