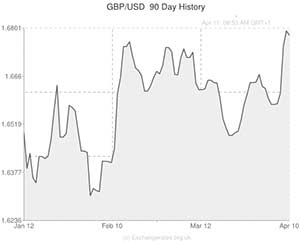

The GBP to USD exchange rate softened to a two day low of 1.67 following the release of positive US economic data.

The ‘Greenback’ also turned broadly higher against most of its major peers due to the release of positive US inflation data which supported demand for the currency. A better than forecast consumer sentiment report also added to the currency’s strength.

It’s been a poor week for the US Dollar after the currency received a bit of a kicking as it weakened against most major currencies. The FOMC minutes for March saw the Dollar tumble as investors were disappointed that it suggested that an early hike of interest rates is unlikely.

Producer price inflation in the US rose by 0.5% in March, exceeding forecasts for a rise of 0.1% and was a rebound from the previous month’s decline of 0.2%. The figure was the best rise recorded since June last year.

Separately the Thomson Reuters/University of Michigan preliminary consumer sentiment index for April climbed to 82.6 from the previous month’s figure of 80. The index was better than expectations. Economists had been expecting a figure of 81.

The Pound meanwhile was under pressure after data showed that construction output in the UK fell sharply in February as the winters bad weather halted building work. According to the ONS output fell by 2.8% from the previous month.

The next major data release for the US Dollar is due next Monday when the latest retail sales data is published. A strong showing from those figures is likely to buoy the currency and increase sentiment towards the world’s largest economy.

US Dollar (USD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

US Dollar, ,Pound Sterling,0.5978 ,

,Pound Sterling,0.5978 ,

US Dollar, ,Euro,0.7204 ,

,Euro,0.7204 ,

US Dollar, ,Australian Dollar,1.0637 ,

,Australian Dollar,1.0637 ,

US Dollar, ,Canadian Dollar,1.0952 ,

,Canadian Dollar,1.0952 ,

Pound Sterling, ,US Dollar,1.6728 ,

,US Dollar,1.6728 ,

[/table]

Comments are closed.