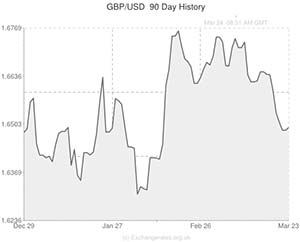

The GBP to USD exchange rate plunged to a fresh monthly low of 1.6466 during the Asian session, but Sterling quickly reasserted itself above technical support at 1.6475.

Sterling has enjoyed a bullish run against the US Dollar over the last eight months, but the Pound’s luck may have run out and the currency pair could begin to depreciate over the next few weeks.

Last Wednesday Federal Reserve Chairwoman Janet Yellen surprised markets by commenting that the Central Bank would “probably” only wait six months to start hiking interest rates once the QE3 asset purchasing programme is shutdown. This caused investors to begin pricing in the possibility that the Fed could start raising rates as early as next April.

With the Fed and the Bank of England now both expected to start hiking rates at around the same time the Pound no longer has a positive rate hike bias over the US Dollar. This could lead to a correction lower in the Pound to US Dollar exchange rate.

Key support exists at 1.6475 but if cable settles below this level then it is entirely possible that the ‘Greenback’ could push GBP to USD down towards significant support at 1.6300.

Data due out this week is likely to strengthen demand for the US Dollar and weaken support for Sterling.

The US Manufacturing PMI for March is predicted to print at 56.5, which is slightly lower than February’s 57.1 but is still a fairly robust score. The other major economic indicator is forecast to show that American Durable Goods Orders rebounded from a -1.0% contraction in January to expand by +1.0% during February.

In Britain Retail Sales are set to have slowed from 4.8% to 2.9% in February and the UK Consumer Price Index is anticipated to have decelerated from 1.9% to 1.7%. If inflation does fall to this level then it will make it slightly easier for the Bank of England to hold interest rates at the current record low for longer.

Another factor that could benefit the US Dollar over the Pound is the ongoing political crisis in Ukraine. Twelve more Russians were subject to sanctions on Friday and Russia’s sizable military force on the border has alerted some military analysts to the possibility that President Vladimir Putin could be planning further advances in other former Soviet states. With talk of Moldova being the next target, US Senator John McCain compared Putin’s tactics to those of Adolf Hitler.

British Prime Minister David Cameron said that Russia relies on Europe more than Europe relies on Russia:

“Europe is 25% or so reliant on Russian gas but if you look at Gazprom’s revenues something like 50% of them come from Europe…So Russia needs Europe more than Europe needs Russia.

Nevertheless, if the crisis continues to escalate then it could have a negative impact on the global economy, which in turn could bolster demand for the safe haven US Dollar.

Comments are closed.