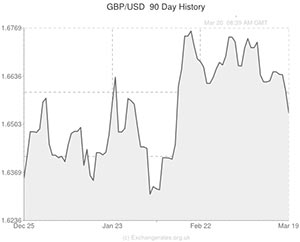

Yesterday’s UK news boosted the Pound against most of its peers, but the US Dollar turned bullish overnight and the GBP/USD pairing is still struggling today.

Over the course of the European session the Pound held yesterday’s gains as the UK CBI trends data showed improvement, adding to the brightening picture of Britain’s economic recovery.

However, the Federal Open Market Committee’s policy announcement triggered widespread ‘Greenback’ gains and the Pound just couldn’t keep up.

The Federal Reserve’s decision to continue with the steady tapering of stimulus and hint at interest rate increases occurring before the end of the year pushed the US Dollar to multi-week highs against several of its counterparts.

In North American trading the US Dollar held fairly steady despite a mixed bag of domestic economic data.

Firstly, figures showed that the number of American’s filling for jobless applications climbed to 320,000 in the week ending March 15th.

The 5,000 gain was less than the increase of 7,000 expected.

However, the four-week moving average of US jobless claims fell to its lowest level for over three months.

According to Bloomberg News, the report prompted this response from economist Jim O’Sullivan; ‘Claims remain extremely encouraging. They’re signalling that the net slowing in payrolls gains in the last few months is weather-related and temporary, and we’re due for some catch-up payrolls over the next couple of months.’

However, the Bloomberg Consumer Comfort Index dropped from -27.6 to -29 in its first drop for six weeks.

The measure indicates that American citizens were at their least optimistic for four months and reflects the economic difficulties inspired by an unseasonably harsh winter.

Finally, US existing home sales plummeted to their lowest level since mid 2012 last month.

Sales declined by 0.4 per cent, as forecast by economists, following a slump of 5.1 per cent the previous month.

One industry expert said of the report; ‘It may take some time to get sales back on track after the weather effect. Home sales will keep growing this year though maybe not at the pace we saw last year. Rising mortgage rates are a modest negative for demand.’

After the data was published the US Dollar continued trading close to a two-week high against the Euro and remained stronger against the majority of its peers.

With US news limited tomorrow, the UK’s public sector net borrowing figures will be responsible for much of the Pound to US Dollar (GBP/USD) pairing’s movement before the weekend.

US Dollar (USD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

US Dollar, ,Pound Sterling,0.6061,

,Pound Sterling,0.6061,

US Dollar, ,Canadian Dollar,1.1257,

,Canadian Dollar,1.1257,

US Dollar, ,Euro,0.7263,

,Euro,0.7263,

US Dollar, ,Australian Dollar,1.1094,

,Australian Dollar,1.1094,

US Dollar, ,New Zealand Dollar,1.1739 ,

,New Zealand Dollar,1.1739 ,

Canadian Dollar, ,US Dollar ,0.8873 ,

,US Dollar ,0.8873 ,

Pound Sterling, ,US Dollar,1.6499 ,

,US Dollar,1.6499 ,

Euro, ,US Dollar,1.3773,

,US Dollar,1.3773,

Australian Dollar, ,US Dollar,0.9018,

,US Dollar,0.9018,

New Zealand Dollar, ,US Dollar,0.8527 ,

,US Dollar,0.8527 ,

[/table]

Comments are closed.