Although the Rand was struggling yesterday as investors focused on the upcoming Federal Open Market Committee meeting, the South African currency was able to recover losses and advance on peers like the Pound and US Dollar following the Reserve Bank’s rate decision and remarks issued by the South African Finance Minister.

The Reserve Bank of South Africa followed in the footsteps of the central banks of India and Turkey by issuing a surprise benchmark interest rate increase.

The benchmark rate was increased to 5.5 per cent from 5 per cent.

The rate increase was the first since mid-2008.

Although the Rand initially extended declines against its rivals, hitting a low of 11.3803 against the US Dollar, the commodity-driven asset clawed back losses against some of its rivals after Finance Minister Pravin Gordhan stressed that the Rand has been oversold.

During a speech in Johannesburg Pravin stated that the Rand is currently trading below its fair value, and while this will improve conditions for exporters it will serve to increase import costs.

Of course Rand gains against the US Dollar were tempered by the Federal Open Market Committee’s decision to taper stimulus by 10 billion Dollars, lessening the appeal of emerging market assets.

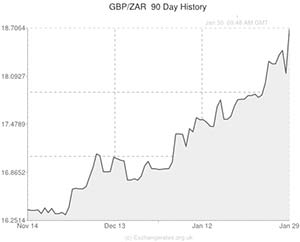

However, the South African currency extended its advance against the Pound as UK mortgage approvals were shown to have increased by less than expected in December, coming in at 71,600 rather than the 72,900 expected.

This morning reports showed that South African private sector credit came in at 6.1 per cent in December, year-on-year, down from 6.9 per cent in November but in line with estimates.

Meanwhile, domestic factory gate inflation accelerated by more than anticipated.

The manufacturing sector’s producer price index climbed by 6.5 per cent in December, year-on-year, up from growth of 5.8 per cent the previous month.

Economists had envisaged a 6.1 per cent annual gain for December.

Month-on-month, producer prices increased by 0.5 per cent vs. expectations for a 0.2 per cent increase.

Tomorrow’s South African trade balance report could influence the direction the GBP/ZAR pairing takes before the weekend, but the UK consumer confidence report will also be of interest.

Given the falling levels of unemployment and upbeat economic data the UK has enjoyed in recent months it seems likely that the GfK consumer confidence survey will show improvement.

If the measure advances from -13 to -12 as predicted the Pound will be supported, but we forecast that a better-than-anticipated result will help the GBP/ZAR pairing recover.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,18.6166 ,

,South African Rand,18.6166 ,

Euro, ,South African Rand,15.3645,

,South African Rand,15.3645,

US Dollar, ,South African Rand,11.3776 ,

,South African Rand,11.3776 ,

Australian Dollar, ,South African Rand,9.9366 ,

,South African Rand,9.9366 ,

New Zealand Dollar, ,South African Rand,9.2229,

,South African Rand,9.2229,

Canadian Dollar, ,South African Rand,10.0744,

,South African Rand,10.0744,

[/table]

Comments are closed.