Sterling stumbled a little yesterday as UK services PMI broke the recent trend of better-than-forecast data by coming in below the 62.0 level predicted. But while the British asset was holding steady against the US Dollar it modestly extended declines against the Euro as the European session opened and the pressure of the looming Autumn statement and Bank of England Rate decision increased.

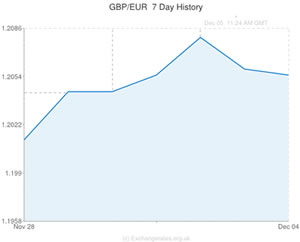

The Pound Sterling to Euro Exchange Rate was in the region of 1.2035 as of 12:20 GMT

As local trading progressed the Pound softened slightly against the majority of its currency counterparts in response to the Autumn Statement, delivered by Chancellor of the Exchequer George Osborne.

Although Osborne stressed that the UK’s growth outlook has improved, he went on to state that the government hasn’t finished introducing measures to support the economy.

Osborne asserted; ‘Britain’s economic plan is working. But the job is not done. We need to secure the economy for the long term’.

Osborne positively revised his growth forecast for 2013 from 0.6 per cent to 1.4 per cent.

The UK economy is now expected to grow by 2.4 per cent in 2014.

Immediately following Osborne’s announcement industry expert Neil Jones commented; ‘It’s an interesting day for the Pound in the UK, it’s a glimpse into the future of monetary and fiscal policy. There’s an expectation for a more upbeat political and monetary BoE stance. Things are getting better and going in the right direction. In the longer term that will send the Pound higher still.’

1 Euro is currently worth 0.8311 pence

Shortly after Osborne spoke the Bank of England announced its decision to hold the benchmark interest rate at a record low, as expected by economists. The level of asset purchases also remained the same.

The Pound slipped against the Euro ahead of the European Central Bank’s rate decision and posted a decline against the US Dollar prior to the release of several influential reports for the world’s largest economy.

Further GBP/USD movement can be expected to occur in response to today’s US initial jobless claims, factory orders and GDP reports.

If the figures show that the US economy expanded by more than anticipated in the third quarter, adding to the case for the Federal Reserve tapering stimulus in September, the Pound could give up recent gains against the ‘Greenback’.

Current Pound Sterling (GBP) Exchange Rates:

< Down > Up

The Pound Sterling/US Dollar Exchange Rate is currently in the region of: 1.6358 <

The Pound Sterling/Euro Exchange Rate is currently in the region of: 1.2035 <

The Pound Sterling/Australian Dollar Exchange Rate is currently in the region of: 1.8115 <

The Pound Sterling/New Zealand Dollar Exchange Rate is currently in the region of: 1.9946 <

The US Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.6116 >

The Euro/Pound Sterling Exchange Rate is currently in the region of: 0.8311 >

The Australian Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.5521 >

The New Zealand Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.5012 >

(As of 12:20 GMT)

Comments are closed.