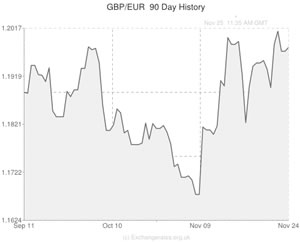

Sterling had another strong week last week and was able to briefly push through the key 1.20 mark against the Euro and even managed to reach the 1.62 region against the US Dollar.

During Monday’s session the Pound was little moved against the Euro after data showed that UK house prices declined in the month of November. According to data compiled by one of the UK’s main housing company’s, house prices in England and Wales fell by 2.4%. That data did little to soften the currency as by the afternoon Sterling was trading close to a three-week high against the US Dollar. The currency remained supported by the prior week’s positive data releases and as investors awaited the publication of the Bank of England’s November policy meeting.

On Tuesday the currency climbed after it received support due to the OEDC sharply revising its forecasts for the UK economy. The organisation said that the nation’s economy will expand by 1.4% this year and by 2.4% in 2014, up from 0.8% and 1.5% it forecasted earlier in the year.

Midweek the Pound soared against the Euro and hit a three-week high against the US Dollar as speculation continues to build that the Bank of England will raise interest rates earlier than expected as the UK economy improves. The minutes for the BoE’s November meeting were largely ignored as investors instead focused on last week’s UK unemployment data for guidance.

The Pound then spent Thursday’s session firmer against the Euro and US Dollar after it found support from data which showed that the UK’s budget deficit narrowed in October. A separate report showed that new orders for UK factories climbed to its highest level in 8 years. The positive reports bolstered confidence that the UK economy is on track to expand faster than the BoE initially predicted.

The coming week sees the release of a number of housing reports but the biggest potential mover for the Pound will come on Wednesday as the GDP growth rate and CBI trade surveys are released. Both sets of data will give investors clearer guidance as to whether the UK economy is continuing to improve.

Current Pound Sterling (GBP) Exchange Rates:

The Pound Sterling/US Dollar Exchange Rate is currently in the region of: 1.6196

The Pound Sterling/Euro Exchange Rate is currently in the region of: 1.1981

The Pound Sterling/Australian Dollar Exchange Rate is currently in the region of: 1.7684

The Pound Sterling/New Zealand Dollar Exchange Rate is currently in the region of: 1.9723

The US Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.6174

The Euro/Pound Sterling Exchange Rate is currently in the region of: 0.8344

The Australian Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.5654

The New Zealand Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.5069

(As of 11:40 am GMT)

Key events for the week ahead

Tuesday November 26th – Nationwide housing prices data

Wednesday November 27th – GDP growth rate

CBI Distributive trade survey

Comments are closed.