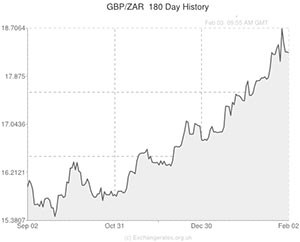

Over the course of European trading the Pound softened against the Rand as a gauge of UK manufacturing output failed to meet expectations, justifying the Bank of England’s decision to hold interest rates at record lows for the foreseeable future.

Sterling slid against the majority of its currency counterparts as UK manufacturing PMI came in at 56.7 in January, less than the reading of 57.3 expected and down from a negatively revised 57.2 in December.

Although the index remains above the 50 mark separating growth from contraction, investors got used to UK data surprising to the upside last year and signs that the nation’s economic recovery might not be as assured as some reports suggested have a tendency to weigh on both the British outlook and the Pound.

On the upside, the UK report did show a ninth consecutive month of improvement in the employment sector.

Markit economist Rob Dobson said this of the manufacturing figure; ‘Although the pace of output expansion has cooled slightly in recent months, growth is still tracking at one of the highest rates in the 22-year survey history. The broad base of the upturn is remarkable, with its benefits being felt across all product categories’.

However, in spite of this optimistic tone the Pound continued to trade lower against the Rand.

While a lingering aversion to emerging market assets reduced the Rand’s appeal and saw the USD/ZAR pairing gain, the commodity-driven currency was holding its own against Sterling ahead of the Bank of England’s rate announcement on Thursday.

The Reserve Bank of South Africa’s decision to introduce an unexpected rate increase last week may have failed to limit the Rand’s declines but the currency received some support as the nation’s Finance Minister stressed that the current volatility was excessive.

Today’s publication of the Kagiso manufacturing PMI report for South Africa had little effect on the Rand this morning.

The measure came in at 49.9 in January, unchanged from the previous month and below estimates for a reading of 50.3.

The result was the country’s weakest since April of last year.

In the opinion of Kagiso researcher Abdul Davids; ‘Given that local demand is likely to remain relatively weak, manufacturers may be expecting a boost to exports due to improved demand from the Eurozone and a possible competitive edge from the weak Rand.’

Although the Rand remains stronger against the Pound the South African asset may extend declines against the US Dollar if today’s US manufacturing reports show improvement.

Conversely, if Wednesday’s services PMI for the UK also fails to reach estimates additional GBP/ZAR losses could occur as the week progresses.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,18.0760,

,South African Rand,18.0760,

Euro, ,South African Rand,14.9969,

,South African Rand,14.9969,

US Dollar, ,South African Rand,11.0670 ,

,South African Rand,11.0670 ,

Australian Dollar, ,South African Rand,9.7259,

,South African Rand,9.7259,

New Zealand Dollar, ,South African Rand,9.1685,

,South African Rand,9.1685,

Canadian Dollar, ,South African Rand,9.9856,

,South African Rand,9.9856,

[/table]

Comments are closed.